In an October 20, 2009 speech before the Scottish Business Organizations in Edinburgh, Bank of England Governor Mervyn King weighed in on financial system regulatory reform. Among other things, he discussed moral hazard associated with governments coming to the rescue of troubled financial institutions and the need to address the “too big to fail” or, as he described it, “too important to fail,” issue. His insights are relevant far beyond the boundaries of the United Kingdom.

He asserted that there are two ways to address that problem: “One is to accept that some institutions are ‘too important to fail’ and try to ensure that the probability of those institutions failing, and hence of the need for taxpayer support, is extremely low” and “The other is to find a way that institutions can fail without imposing unacceptable costs on the rest of society.”

The first approach could be pursued by requiring banks to “take out insurance in the form of ‘contingent capital.’” Contingent capital would essentially be debt or preferred equity that automatically converts to common equity before a bank becomes insolvent. The theory behind contingent capital is that its highly dilutive impact would create disincentives for financial institutions to take the kind of excessive risks that would imperil their survival. Nonetheless, King argued that drawbacks would make prospects for that approach’s success uncertain.

The second approach would require segregating financial institutions’ basic role in intermediating savings to finance investment from their riskier activities such as proprietary trading. Under such an approach, the government would provide guarantees only for the basic banking services. Former Federal Reserve Chairman Paul Volcker supports a variant of this approach in which banks would be barred from owning or trading risky securities for their own accounts. Simon Johnson, former chief economist of the International Monetary Fund goes even farther in raising the question as to whether “we have to break up the biggest banks.”

For now, there remains no consensus on how to address the “too big to fail” issue. In the United States, the debate on financial system regulatory reform has taken a backseat to the health reform discussion and it remains to be seen whether King’s, Volcker’s, or Johnson’s insights will receive serious consideration. Historical experience suggests that the passage of time and onset of economic recovery will probably reduce the scope of financial system reform emerging in the wake of the recent crisis.

&&

Wednesday, October 21, 2009

Wednesday, October 7, 2009

Data Highlight Unfolding U-Shaped Recovery

Recent economic data continues to suggest that the U.S. is probably near the bottom of its recession or in the very early stages of resuming economic growth. At such junctures, there can be fluctuations between growth and contraction in some sectors of the economy. At the same time, some sectors can lag when it comes to a return to sustained growth.

In the near-term, aside from Q3 GDP, for which the growth figure will likely be distorted by the “cash for clunkers” program (final demand will be a better indicator), overall growth over the next 2-4 quarters will probably remain sluggish (real annualized rate of 2% or less for most of them and for the 2009 Q2-2010 Q2 timeframe as a whole).

A “U-shaped” scenario does not represent a “new normal” to use the lingo that has proliferated in the media. Instead, it reflects the historic experience following the collapse of asset bubbles that leave a substantial debt burden in their wake. During such times, those who accumulated the sizable debt burdens tend to deleverage. With respect to the housing bubble, it was U.S. households that accumulated a historically high debt burden. Now, households are continuing to deleverage. Today’s higher than expected contraction of consumer credit is just the latest confirmation of the deleveraging trend. Such deleveraging will tend to restrain growth in real personal consumption expenditures, which still comprises roughly 70% of GDP.

Looking ahead, the labor market will likely remain a significant drag through next year, even as the unemployment rate probably peaks early next year and then begins to slowly decline. In addition, there is a structural component to the unemployment rate. Not all jobs will return. Certain sectors will likely remain notably smaller than they were in the past following the recession.

The labor participation rate, which has fallen to 65.2% of the civilian noninstitutional population could reach or drop below 65%. To put this into perspective, during the 1990-99 timeframe, the labor participation rate averaged 66.7% of the civilian noninstitutional population. At the present rate (65.2%), the labor force is 3.55 million persons smaller than it would have been at the 1990-99 labor participation rate.

An inefficient employment services sector will likely undermatch and frequently fail to match qualified employees with employers who have openings. Such a phenomenon could further slow the recovery in the job market, lengthen the duration of unemployment, and possibly contribute to some unemployed workers leaving the labor force altogether.

All those developments will likely translate into elevated consumer and real estate loan delinquencies and charge-offs and reduced growth in real personal consumption expenditures. In turn, dozens of additional bank failures are likely in coming months. A brief burst of growth in corporate profits brought about due to higher productivity/lower wage expenses could slow markedly afterward until top-line revenue growth picks up. Inflation will remain abnormally low through the rest of this year into at least part of next year. In response, the Fed will maintain its present monetary policy stance through the rest of this year and probably into at least part of next year.

&&

In the near-term, aside from Q3 GDP, for which the growth figure will likely be distorted by the “cash for clunkers” program (final demand will be a better indicator), overall growth over the next 2-4 quarters will probably remain sluggish (real annualized rate of 2% or less for most of them and for the 2009 Q2-2010 Q2 timeframe as a whole).

A “U-shaped” scenario does not represent a “new normal” to use the lingo that has proliferated in the media. Instead, it reflects the historic experience following the collapse of asset bubbles that leave a substantial debt burden in their wake. During such times, those who accumulated the sizable debt burdens tend to deleverage. With respect to the housing bubble, it was U.S. households that accumulated a historically high debt burden. Now, households are continuing to deleverage. Today’s higher than expected contraction of consumer credit is just the latest confirmation of the deleveraging trend. Such deleveraging will tend to restrain growth in real personal consumption expenditures, which still comprises roughly 70% of GDP.

Looking ahead, the labor market will likely remain a significant drag through next year, even as the unemployment rate probably peaks early next year and then begins to slowly decline. In addition, there is a structural component to the unemployment rate. Not all jobs will return. Certain sectors will likely remain notably smaller than they were in the past following the recession.

The labor participation rate, which has fallen to 65.2% of the civilian noninstitutional population could reach or drop below 65%. To put this into perspective, during the 1990-99 timeframe, the labor participation rate averaged 66.7% of the civilian noninstitutional population. At the present rate (65.2%), the labor force is 3.55 million persons smaller than it would have been at the 1990-99 labor participation rate.

An inefficient employment services sector will likely undermatch and frequently fail to match qualified employees with employers who have openings. Such a phenomenon could further slow the recovery in the job market, lengthen the duration of unemployment, and possibly contribute to some unemployed workers leaving the labor force altogether.

All those developments will likely translate into elevated consumer and real estate loan delinquencies and charge-offs and reduced growth in real personal consumption expenditures. In turn, dozens of additional bank failures are likely in coming months. A brief burst of growth in corporate profits brought about due to higher productivity/lower wage expenses could slow markedly afterward until top-line revenue growth picks up. Inflation will remain abnormally low through the rest of this year into at least part of next year. In response, the Fed will maintain its present monetary policy stance through the rest of this year and probably into at least part of next year.

&&

Wednesday, September 30, 2009

Building a Credible Sanctions Regime to Facilitate P5+1 Negotiations with Iran

Tomorrow, the opening of the P5+1 (Permanent Members of the Security Council + Germany)-Iran talks is likely to produce few significant changes. Instead, the P5+1 will likely seek assurances that Iran’s nuclear program is intended for peaceful purposes, Iran works with the International Atomic Energy Agency (IAEA) to resolve outstanding issues, and Iran takes a much more transparent approach with its nuclear program. Iran, on the other hand, is likely to try to shift the emphasis to broader issues outside the scope of its nuclear program.

In part, Iran’s incentive to remain intransigent is the result of its calculation that no severe sanctions are likely. Instead, because Iran’s economy is not highly integrated with the world’s major economies, sanctions concerning oil industry parts or financial flows are likely to have only a limited adverse impact. With Iran recently entering into an agreement to purchase refined petroleum products from Venezuela, a sanctions regime that deprives Iran of such products is also unlikely to be very effective. The single sanction that could break Iran, namely its ability to sell oil on the world market, is highly unlikely.

Briefly, it is that sanction that would hold the best promise of breaking Iranian rigidity for several reasons:

• Petroleum accounts for 80% of Iran’s exports. Oil revenue amounts to 113% of Iran’s imports. Without oil revenue, Iran’s current account deficit would explode.

• Just five countries account for nearly 72% of Iran’s oil exports: Japan, China, India, South Korea, and Italy.

• Venezuela, with which Iran has been steadily deepening relations, is an oil exporter and would be unlikely to purchase crude oil from Iran.

• A shutdown of Iran’s oil sector would exacerbate that country’s 12.5% unemployment rate.

However, to bring the small number of countries, including China, into alignment on a severe sanctions regime that targets Iran’s oil industry would likely require the United States taking measures to assure their access to oil at a reasonable price. One mechanism that could be explored would entail the U.S. committing to sell oil from its strategic petroleum reserve at a discount from world prices to buffer the impact of the loss of Iranian oil on those countries. Although such an approach is not assured to produce the commitment to such a sanctions regime, should it become necessary, it could constitute a step in that direction.

Beyond diplomacy, the policy options involved become much less pleasant. One such option would constitute the construction of a credible deterrent e.g., in the form of a U.S. commitment that would translate into Iran’s destruction were Iran to launch or attempt a nuclear strike and/or proliferate nuclear weapons. Even then, the Middle East’s balance of power would be dramatically altered on dimensions concerning state power, the capabilities of non-state actors, and in terms of the Sunni-Shia rivalry. Another option would entail military strikes. Such strikes would likely be costly considering the need for some ground component to destroy buried nuclear facilities and risk of retaliation by Iran and its proxies (Hamas and Hezbollah). Such strikes might only briefly delay Iran’s attaining a nuclear weapons capacity, especially if Iran has additional hidden facilities.

Therefore, given tradeoffs involved were diplomacy to fail, it makes sense to put the pieces in place to maximize the prospects of diplomatic success keeping in mind that a diplomatic breakthrough would need to accommodate the core needs of all parties. In principle, a diplomatic breakthrough would probably allow Iran an ability to maintain a civil nuclear energy industry (Iran’s core need) subject to an intrusive verification regime (the international community’s core need in minimizing the risk of nuclear proliferation). A truly rigorous sanctions regime that targets Iran’s oil industry would probably be key to facilitating the negotiating process should Iran take an implacable stand. An oil-sharing agreement to shield leading importers of Iranian oil from the impact of such a sanctions regime would probably strengthen prospects of building such a sanctions regime.

&&

In part, Iran’s incentive to remain intransigent is the result of its calculation that no severe sanctions are likely. Instead, because Iran’s economy is not highly integrated with the world’s major economies, sanctions concerning oil industry parts or financial flows are likely to have only a limited adverse impact. With Iran recently entering into an agreement to purchase refined petroleum products from Venezuela, a sanctions regime that deprives Iran of such products is also unlikely to be very effective. The single sanction that could break Iran, namely its ability to sell oil on the world market, is highly unlikely.

Briefly, it is that sanction that would hold the best promise of breaking Iranian rigidity for several reasons:

• Petroleum accounts for 80% of Iran’s exports. Oil revenue amounts to 113% of Iran’s imports. Without oil revenue, Iran’s current account deficit would explode.

• Just five countries account for nearly 72% of Iran’s oil exports: Japan, China, India, South Korea, and Italy.

• Venezuela, with which Iran has been steadily deepening relations, is an oil exporter and would be unlikely to purchase crude oil from Iran.

• A shutdown of Iran’s oil sector would exacerbate that country’s 12.5% unemployment rate.

However, to bring the small number of countries, including China, into alignment on a severe sanctions regime that targets Iran’s oil industry would likely require the United States taking measures to assure their access to oil at a reasonable price. One mechanism that could be explored would entail the U.S. committing to sell oil from its strategic petroleum reserve at a discount from world prices to buffer the impact of the loss of Iranian oil on those countries. Although such an approach is not assured to produce the commitment to such a sanctions regime, should it become necessary, it could constitute a step in that direction.

Beyond diplomacy, the policy options involved become much less pleasant. One such option would constitute the construction of a credible deterrent e.g., in the form of a U.S. commitment that would translate into Iran’s destruction were Iran to launch or attempt a nuclear strike and/or proliferate nuclear weapons. Even then, the Middle East’s balance of power would be dramatically altered on dimensions concerning state power, the capabilities of non-state actors, and in terms of the Sunni-Shia rivalry. Another option would entail military strikes. Such strikes would likely be costly considering the need for some ground component to destroy buried nuclear facilities and risk of retaliation by Iran and its proxies (Hamas and Hezbollah). Such strikes might only briefly delay Iran’s attaining a nuclear weapons capacity, especially if Iran has additional hidden facilities.

Therefore, given tradeoffs involved were diplomacy to fail, it makes sense to put the pieces in place to maximize the prospects of diplomatic success keeping in mind that a diplomatic breakthrough would need to accommodate the core needs of all parties. In principle, a diplomatic breakthrough would probably allow Iran an ability to maintain a civil nuclear energy industry (Iran’s core need) subject to an intrusive verification regime (the international community’s core need in minimizing the risk of nuclear proliferation). A truly rigorous sanctions regime that targets Iran’s oil industry would probably be key to facilitating the negotiating process should Iran take an implacable stand. An oil-sharing agreement to shield leading importers of Iranian oil from the impact of such a sanctions regime would probably strengthen prospects of building such a sanctions regime.

&&

Labels:

China,

diplomacy,

Iran,

negotiations,

nuclear,

oil-sharing,

strategic petroleum reserve,

United States

Wednesday, September 23, 2009

Fed Sees Economy Beginning to Strengthen

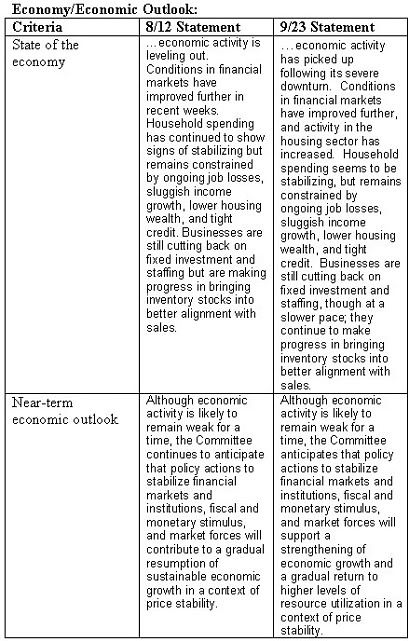

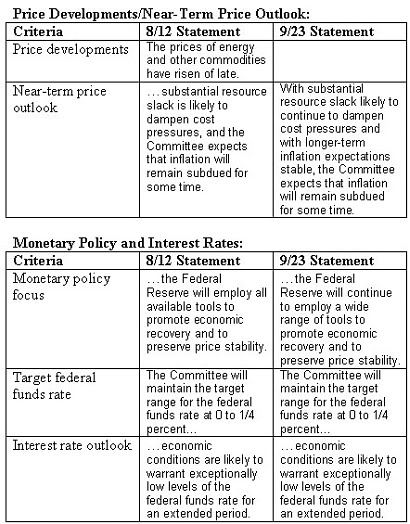

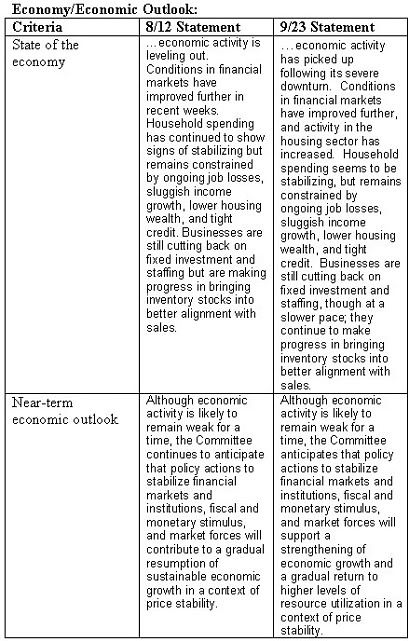

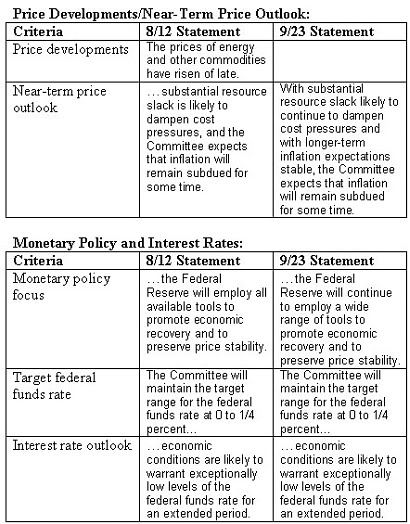

Today, the Federal Reserve’s Federal Open Market Committee (FOMC) left interest rates unchanged. However, the statement explaining its decision indicated that the Federal Reserve now sees the economy in its early stages of strengthening. The Fed has also taken a slightly more robust perspective on near-term economic growth, shifting its language from “a gradual resumption of sustainable economic growth” to “a strengthening of economic growth.” In addition, the FOMC somewhat toned down the language on the Fed’s efforts to promote an economic recovery and maintain price stability. With respect to its extraordinary programs, the Federal Reserve remains on course to end its purchases of Treasury securities in October. In addition, it will extend its purchases of agency mortgage-backed securities and agency debt through the first quarter of 2010. However, it will not expand those programs beyond the earlier announced parameters. The extension of the period during which the Fed will be purchasing such securities has likely been implemented to avoid a sharp cut off of the program.

The following tables compare the FOMC’s August 12 and September 23 monetary policy statements so as to show the continuing evolution of the Fed’s thinking:

&&

The following tables compare the FOMC’s August 12 and September 23 monetary policy statements so as to show the continuing evolution of the Fed’s thinking:

&&

Wednesday, September 16, 2009

U.S. Crude Oil Inventories Continue to Fall

U.S. Crude Oil Inventories Continue to Fall

Consistent with recent seasonality and an emergent economic recovery, U.S. crude oil inventories declined for the forth time in five weeks. The U.S. Energy Information Administration reported that U.S. crude oil inventories had fallen to 332.8 million barrels for the four-week period ended September 11, 2009. All said, U.S. crude oil inventories are now 5.5% lower than the 352.0 million figure for the four-week period ended August 7, 2009. During the same period, U.S. crude oil consumption has increased 2.9%.

With OPEC having decided to leave its production goals unchanged in its most recent meeting, the U.S. and major international economies showing signs of stabilizing or emergent growth, and seasonality continuing to prevail, these developments will very likely preclude a collapse in the price of crude oil predicted by one analyst this year. Instead, oil market fundamentals continue to suggest that any declines would be far shallower. With some recent computer guidance suggesting a possibly colder than normal heating season for populated areas in North America, an increase in crude oil prices as the heating season approaches or commences is plausible.

&&

Consistent with recent seasonality and an emergent economic recovery, U.S. crude oil inventories declined for the forth time in five weeks. The U.S. Energy Information Administration reported that U.S. crude oil inventories had fallen to 332.8 million barrels for the four-week period ended September 11, 2009. All said, U.S. crude oil inventories are now 5.5% lower than the 352.0 million figure for the four-week period ended August 7, 2009. During the same period, U.S. crude oil consumption has increased 2.9%.

With OPEC having decided to leave its production goals unchanged in its most recent meeting, the U.S. and major international economies showing signs of stabilizing or emergent growth, and seasonality continuing to prevail, these developments will very likely preclude a collapse in the price of crude oil predicted by one analyst this year. Instead, oil market fundamentals continue to suggest that any declines would be far shallower. With some recent computer guidance suggesting a possibly colder than normal heating season for populated areas in North America, an increase in crude oil prices as the heating season approaches or commences is plausible.

&&

Wednesday, September 9, 2009

Beige Book: Continuing Economic Stabilization

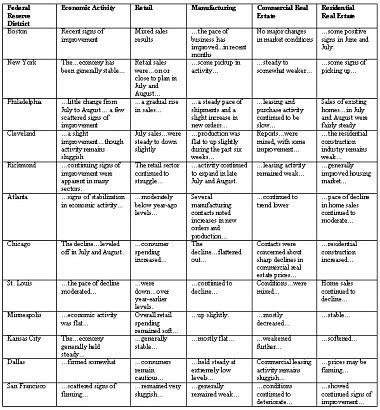

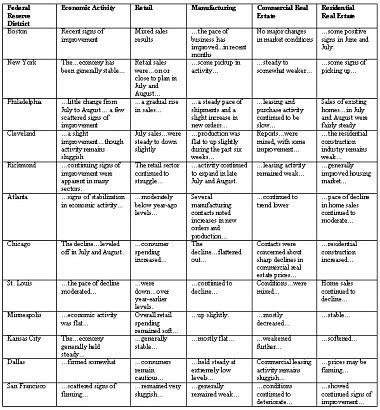

Earlier today, the Federal Reserve released its Beige Book on economic conditions around the nation. The report showed continued stabilization of the overall economy with some indications of improvement. Nevertheless, numerous sectors remained weak.

A table summarizing the report follows:

&&

A table summarizing the report follows:

&&

Friday, August 28, 2009

Bank Failure Snapshot

This evening, the FDIC announced the failure of Baltimore-based Bradford Bank. Bradford is the 82nd bank to fail this year. Since the housing bubble burst, 110 banks have failed. Total assets for those failed banks amount to $465 billion.

Some quick statistics follow:

In addition, three states account for 51 bank failures or 46% of the total to date:

Georgia: 24

Illinois: 14

California: 13

In sum, a quick snapshot reveals:

• The overwhelming majority (79%) of failed banks are small or medium-sized banks.

• The incidence of bank failures has increased markedly during the summer, with July and August accounting for 45% of this year’s failed banks.

• Bank failures have clustered in select states.

&&

Some quick statistics follow:

In addition, three states account for 51 bank failures or 46% of the total to date:

Georgia: 24

Illinois: 14

California: 13

In sum, a quick snapshot reveals:

• The overwhelming majority (79%) of failed banks are small or medium-sized banks.

• The incidence of bank failures has increased markedly during the summer, with July and August accounting for 45% of this year’s failed banks.

• Bank failures have clustered in select states.

&&

Subscribe to:

Posts (Atom)