Typically, U.S. stocks bottom out 3-6 months before the end of a recession and they return to their pre-recession highs, on average, about 3.7 years after having reached that high. The experience following U.S. recessions since 1950 is as follows:

• July 1953-May 1954 recession: Pre-recession peak: 293.79, January 5, 1953; First close at or above that level: 294.03, February 4, 1954; Interval: 1 year, 30 days (395 days).

• August 1957-April 1958 recession: Pre-recession peak: 521.05, April 6, 1956; First close at or above that level: 523.40, September 15, 1958; Interval: 2 years, 5 months, 9 days (892 days).

• April 1960-February 1961 recession: Pre-recession peak: 685.47, January 5, 1960; First close at or above that level: 692.06, April 10, 1961; Interval: 1 year, 3 months, 5 days (461 days).

• December 1969-January 1970 recession: Pre-recession peak: 985.21, December 3, 1968; First close at or above that level: 988.26, November 9, 1972; Interval: 3 years, 11 months, 6 days (1,437 days).

• November 1973-March 1975 recession: Pre-recession peak: 1,051.70, January 11, 1973; First close at or above that level: 1,065.49, November 3, 1982; Interval: 9 years, 9 months, 23 days (3,583 days); Two oil price shocks, an extended period of high inflation, and two recessions (January-July 1980 and July 1981-November 1982) occurred during that nearly 10-year interval.

• July 1990-November 1991 recession: Pre-recession peak: 2,999.75, July 17, 1990; First close at or above that level: 3,004.46, April 17, 1991; Interval: 9 months (274 days).

• March 2001-November 2001 recession: Pre-recession peak: 11,722.98, January 14, 2000; First close at or above that level: 11,727.34, October 3, 2006; Interval: 6 years, 8 months, 19 days (2,454 days); The dot-com bubble burst, the federal government saw budget surpluses that emerged during the late 1990s give way to renewed significant budget deficits, and the September 11, 2001 terrorist attacks occurred during that nearly 7-year interval.

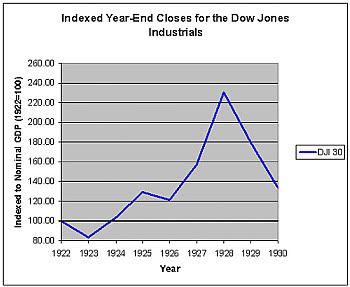

However, in the earlier experience, there have been two occasions during which the Dow Jones Industrials failed to reach its pre-recession peak for 10 years or longer. Those seminal economic events were the Panic of 1907 that produced a credit crunch and severe recession in which real GDP fell 10.8% and the Great Depression during which real GDP contracted by 26.5% in the 1929-33 timeframe. In addition, following the collapse of Japan’s twin stock market and real estate bubbles, its Nikkei 225 Index has remained much below its December 1989 top for more than 19 years.

The Panic of 1907: The Dow Jones Industrials closed at 103.00 on January 19, 1906. The Dow Jones Industrials did not return to that level until it closed at 103.11 on September 28, 1916, an interval of 10 years, 8 months, and 9 days (3,905 days).

The Great Depression: The Dow Jones Industrials closed at 381.17 on September 3, 1929. The Dow Jones Industrials did not return to that level until it closed at 382.74 on November 23, 1954, an interval of 25 years, 2 months, and 2 days (9,212 days).

Japan’s “Lost Decade” of the 1990s-2000s: The Nikkei 225 Index closed at 38,915.87 on December 29, 1989. Through July 10, 2009, the Nikkei has failed to return to that level. That is an interval of 19 years, 6 months, and 11 days (7,133 days). Its last closing price was 9,287.28 on July 10, a figure that is 76% below its December 1989 crest.

In terms of the ongoing “Great Recession” in the United States, the Dow Jones Industrials peaked at 14,164.53 on October 9, 2007. On July 9, the Dow Jones Industrials closed at 8,183.17, which is 42% below its pre-recession peak.

Four possible scenarios could result in the Dow Jones Industrials taking a decade or longer to return to its pre-recession peak:

• In the absence of visible signs of economic recovery, federal policy failures, and a generally unrelenting bear market that turns aside repeated rally attempts, investors could make fundamental changes in their perceptions of risk concerning equities. That development would lead to a long-term reduction in demand for stocks.

• The economic recovery from the current severe recession would be fairly brief. Perhaps, a double-dip recession scenario would unfold. At the same time, on account of a fragile financial system that takes time to heal and increased leverage that needs to be worked off by households, recessions could grow more frequent in succeeding years. During the pre-World War II era (1857 through 1945), the median duration of economic expansions was 22 months and the mean length was 29 months. During the post-World War II period, those figures more than doubled to 45 and 58 months respectively. There is no assurance that the post-World War II experience of notably longer business expansions will persist.

• The U.S. could still experience a systemic financial crisis that severely damages its financial institutions, the development and onset of deflation from a premature withdrawal of fiscal and monetary stimulus, or a currency crisis should it encounter difficulty raising funds to support its economic stimulus efforts and underwrite possible new programs.

• A major geopolitical shock or shocks that have a substantial adverse impact on the U.S. and international economies. Such shocks could include, but would not be limited to the outbreak of conflict in a geopolitically crucial part of the world, the collapse of a government and radical changes in policy in a nation whose economy is intensely interconnected with the world’s major economies, a catastrophic natural disaster that devastates a globally-important financial center.

Conclusion:Given the past experience following the severe 1973-75 recession, the collapse of the dot-com bubble, there is a reasonably likely prospect that the Dow Jones Industrials may not return to its pre-recession high of 14,164.53 until late in 2014 or beyond. The effectiveness of ongoing political efforts to shore up the nation's banking system and revive the economy and whether or not there are additional significant economic and geopolitical shocks will be critical in influencing the timing of a stock market recovery. Should those efforts fail to produce the desired impact, or worse, should they result in consequences that adversely impact or disrupt the nation’s growth trajectory, there is a genuine possibility that the Dow might not return to that level for a decade or longer after its October 9, 2007 record close.

&&

bor

bor