In an October 20, 2009 speech before the Scottish Business Organizations in Edinburgh, Bank of England Governor Mervyn King weighed in on financial system regulatory reform. Among other things, he discussed moral hazard associated with governments coming to the rescue of troubled financial institutions and the need to address the “too big to fail” or, as he described it, “too important to fail,” issue. His insights are relevant far beyond the boundaries of the United Kingdom.

He asserted that there are two ways to address that problem: “One is to accept that some institutions are ‘too important to fail’ and try to ensure that the probability of those institutions failing, and hence of the need for taxpayer support, is extremely low” and “The other is to find a way that institutions can fail without imposing unacceptable costs on the rest of society.”

The first approach could be pursued by requiring banks to “take out insurance in the form of ‘contingent capital.’” Contingent capital would essentially be debt or preferred equity that automatically converts to common equity before a bank becomes insolvent. The theory behind contingent capital is that its highly dilutive impact would create disincentives for financial institutions to take the kind of excessive risks that would imperil their survival. Nonetheless, King argued that drawbacks would make prospects for that approach’s success uncertain.

The second approach would require segregating financial institutions’ basic role in intermediating savings to finance investment from their riskier activities such as proprietary trading. Under such an approach, the government would provide guarantees only for the basic banking services. Former Federal Reserve Chairman Paul Volcker supports a variant of this approach in which banks would be barred from owning or trading risky securities for their own accounts. Simon Johnson, former chief economist of the International Monetary Fund goes even farther in raising the question as to whether “we have to break up the biggest banks.”

For now, there remains no consensus on how to address the “too big to fail” issue. In the United States, the debate on financial system regulatory reform has taken a backseat to the health reform discussion and it remains to be seen whether King’s, Volcker’s, or Johnson’s insights will receive serious consideration. Historical experience suggests that the passage of time and onset of economic recovery will probably reduce the scope of financial system reform emerging in the wake of the recent crisis.

&&

Wednesday, October 21, 2009

Wednesday, October 7, 2009

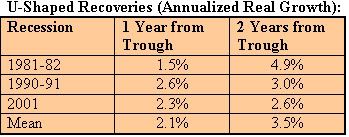

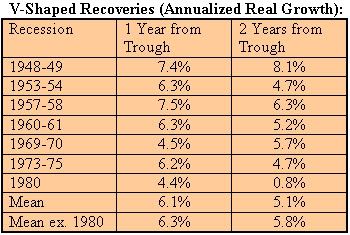

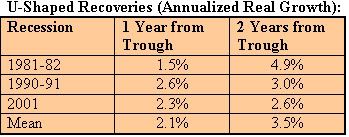

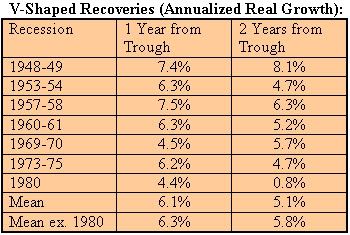

Data Highlight Unfolding U-Shaped Recovery

Recent economic data continues to suggest that the U.S. is probably near the bottom of its recession or in the very early stages of resuming economic growth. At such junctures, there can be fluctuations between growth and contraction in some sectors of the economy. At the same time, some sectors can lag when it comes to a return to sustained growth.

In the near-term, aside from Q3 GDP, for which the growth figure will likely be distorted by the “cash for clunkers” program (final demand will be a better indicator), overall growth over the next 2-4 quarters will probably remain sluggish (real annualized rate of 2% or less for most of them and for the 2009 Q2-2010 Q2 timeframe as a whole).

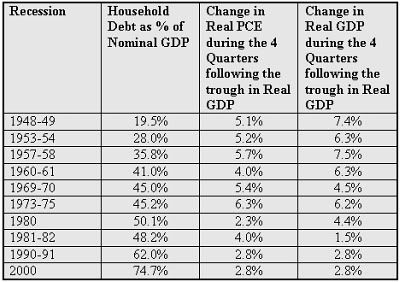

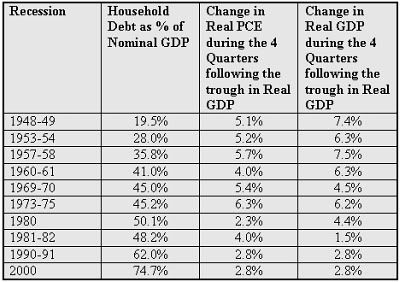

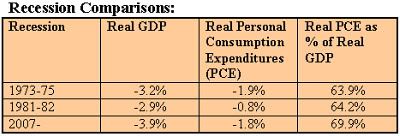

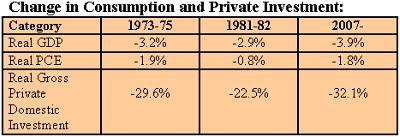

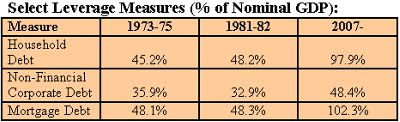

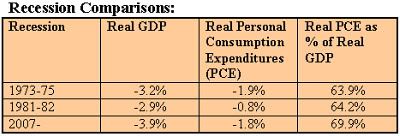

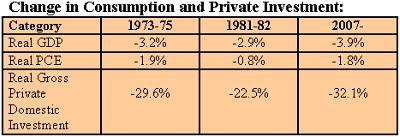

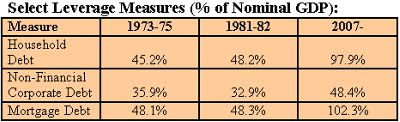

A “U-shaped” scenario does not represent a “new normal” to use the lingo that has proliferated in the media. Instead, it reflects the historic experience following the collapse of asset bubbles that leave a substantial debt burden in their wake. During such times, those who accumulated the sizable debt burdens tend to deleverage. With respect to the housing bubble, it was U.S. households that accumulated a historically high debt burden. Now, households are continuing to deleverage. Today’s higher than expected contraction of consumer credit is just the latest confirmation of the deleveraging trend. Such deleveraging will tend to restrain growth in real personal consumption expenditures, which still comprises roughly 70% of GDP.

Looking ahead, the labor market will likely remain a significant drag through next year, even as the unemployment rate probably peaks early next year and then begins to slowly decline. In addition, there is a structural component to the unemployment rate. Not all jobs will return. Certain sectors will likely remain notably smaller than they were in the past following the recession.

The labor participation rate, which has fallen to 65.2% of the civilian noninstitutional population could reach or drop below 65%. To put this into perspective, during the 1990-99 timeframe, the labor participation rate averaged 66.7% of the civilian noninstitutional population. At the present rate (65.2%), the labor force is 3.55 million persons smaller than it would have been at the 1990-99 labor participation rate.

An inefficient employment services sector will likely undermatch and frequently fail to match qualified employees with employers who have openings. Such a phenomenon could further slow the recovery in the job market, lengthen the duration of unemployment, and possibly contribute to some unemployed workers leaving the labor force altogether.

All those developments will likely translate into elevated consumer and real estate loan delinquencies and charge-offs and reduced growth in real personal consumption expenditures. In turn, dozens of additional bank failures are likely in coming months. A brief burst of growth in corporate profits brought about due to higher productivity/lower wage expenses could slow markedly afterward until top-line revenue growth picks up. Inflation will remain abnormally low through the rest of this year into at least part of next year. In response, the Fed will maintain its present monetary policy stance through the rest of this year and probably into at least part of next year.

&&

In the near-term, aside from Q3 GDP, for which the growth figure will likely be distorted by the “cash for clunkers” program (final demand will be a better indicator), overall growth over the next 2-4 quarters will probably remain sluggish (real annualized rate of 2% or less for most of them and for the 2009 Q2-2010 Q2 timeframe as a whole).

A “U-shaped” scenario does not represent a “new normal” to use the lingo that has proliferated in the media. Instead, it reflects the historic experience following the collapse of asset bubbles that leave a substantial debt burden in their wake. During such times, those who accumulated the sizable debt burdens tend to deleverage. With respect to the housing bubble, it was U.S. households that accumulated a historically high debt burden. Now, households are continuing to deleverage. Today’s higher than expected contraction of consumer credit is just the latest confirmation of the deleveraging trend. Such deleveraging will tend to restrain growth in real personal consumption expenditures, which still comprises roughly 70% of GDP.

Looking ahead, the labor market will likely remain a significant drag through next year, even as the unemployment rate probably peaks early next year and then begins to slowly decline. In addition, there is a structural component to the unemployment rate. Not all jobs will return. Certain sectors will likely remain notably smaller than they were in the past following the recession.

The labor participation rate, which has fallen to 65.2% of the civilian noninstitutional population could reach or drop below 65%. To put this into perspective, during the 1990-99 timeframe, the labor participation rate averaged 66.7% of the civilian noninstitutional population. At the present rate (65.2%), the labor force is 3.55 million persons smaller than it would have been at the 1990-99 labor participation rate.

An inefficient employment services sector will likely undermatch and frequently fail to match qualified employees with employers who have openings. Such a phenomenon could further slow the recovery in the job market, lengthen the duration of unemployment, and possibly contribute to some unemployed workers leaving the labor force altogether.

All those developments will likely translate into elevated consumer and real estate loan delinquencies and charge-offs and reduced growth in real personal consumption expenditures. In turn, dozens of additional bank failures are likely in coming months. A brief burst of growth in corporate profits brought about due to higher productivity/lower wage expenses could slow markedly afterward until top-line revenue growth picks up. Inflation will remain abnormally low through the rest of this year into at least part of next year. In response, the Fed will maintain its present monetary policy stance through the rest of this year and probably into at least part of next year.

&&

Wednesday, September 30, 2009

Building a Credible Sanctions Regime to Facilitate P5+1 Negotiations with Iran

Tomorrow, the opening of the P5+1 (Permanent Members of the Security Council + Germany)-Iran talks is likely to produce few significant changes. Instead, the P5+1 will likely seek assurances that Iran’s nuclear program is intended for peaceful purposes, Iran works with the International Atomic Energy Agency (IAEA) to resolve outstanding issues, and Iran takes a much more transparent approach with its nuclear program. Iran, on the other hand, is likely to try to shift the emphasis to broader issues outside the scope of its nuclear program.

In part, Iran’s incentive to remain intransigent is the result of its calculation that no severe sanctions are likely. Instead, because Iran’s economy is not highly integrated with the world’s major economies, sanctions concerning oil industry parts or financial flows are likely to have only a limited adverse impact. With Iran recently entering into an agreement to purchase refined petroleum products from Venezuela, a sanctions regime that deprives Iran of such products is also unlikely to be very effective. The single sanction that could break Iran, namely its ability to sell oil on the world market, is highly unlikely.

Briefly, it is that sanction that would hold the best promise of breaking Iranian rigidity for several reasons:

• Petroleum accounts for 80% of Iran’s exports. Oil revenue amounts to 113% of Iran’s imports. Without oil revenue, Iran’s current account deficit would explode.

• Just five countries account for nearly 72% of Iran’s oil exports: Japan, China, India, South Korea, and Italy.

• Venezuela, with which Iran has been steadily deepening relations, is an oil exporter and would be unlikely to purchase crude oil from Iran.

• A shutdown of Iran’s oil sector would exacerbate that country’s 12.5% unemployment rate.

However, to bring the small number of countries, including China, into alignment on a severe sanctions regime that targets Iran’s oil industry would likely require the United States taking measures to assure their access to oil at a reasonable price. One mechanism that could be explored would entail the U.S. committing to sell oil from its strategic petroleum reserve at a discount from world prices to buffer the impact of the loss of Iranian oil on those countries. Although such an approach is not assured to produce the commitment to such a sanctions regime, should it become necessary, it could constitute a step in that direction.

Beyond diplomacy, the policy options involved become much less pleasant. One such option would constitute the construction of a credible deterrent e.g., in the form of a U.S. commitment that would translate into Iran’s destruction were Iran to launch or attempt a nuclear strike and/or proliferate nuclear weapons. Even then, the Middle East’s balance of power would be dramatically altered on dimensions concerning state power, the capabilities of non-state actors, and in terms of the Sunni-Shia rivalry. Another option would entail military strikes. Such strikes would likely be costly considering the need for some ground component to destroy buried nuclear facilities and risk of retaliation by Iran and its proxies (Hamas and Hezbollah). Such strikes might only briefly delay Iran’s attaining a nuclear weapons capacity, especially if Iran has additional hidden facilities.

Therefore, given tradeoffs involved were diplomacy to fail, it makes sense to put the pieces in place to maximize the prospects of diplomatic success keeping in mind that a diplomatic breakthrough would need to accommodate the core needs of all parties. In principle, a diplomatic breakthrough would probably allow Iran an ability to maintain a civil nuclear energy industry (Iran’s core need) subject to an intrusive verification regime (the international community’s core need in minimizing the risk of nuclear proliferation). A truly rigorous sanctions regime that targets Iran’s oil industry would probably be key to facilitating the negotiating process should Iran take an implacable stand. An oil-sharing agreement to shield leading importers of Iranian oil from the impact of such a sanctions regime would probably strengthen prospects of building such a sanctions regime.

&&

In part, Iran’s incentive to remain intransigent is the result of its calculation that no severe sanctions are likely. Instead, because Iran’s economy is not highly integrated with the world’s major economies, sanctions concerning oil industry parts or financial flows are likely to have only a limited adverse impact. With Iran recently entering into an agreement to purchase refined petroleum products from Venezuela, a sanctions regime that deprives Iran of such products is also unlikely to be very effective. The single sanction that could break Iran, namely its ability to sell oil on the world market, is highly unlikely.

Briefly, it is that sanction that would hold the best promise of breaking Iranian rigidity for several reasons:

• Petroleum accounts for 80% of Iran’s exports. Oil revenue amounts to 113% of Iran’s imports. Without oil revenue, Iran’s current account deficit would explode.

• Just five countries account for nearly 72% of Iran’s oil exports: Japan, China, India, South Korea, and Italy.

• Venezuela, with which Iran has been steadily deepening relations, is an oil exporter and would be unlikely to purchase crude oil from Iran.

• A shutdown of Iran’s oil sector would exacerbate that country’s 12.5% unemployment rate.

However, to bring the small number of countries, including China, into alignment on a severe sanctions regime that targets Iran’s oil industry would likely require the United States taking measures to assure their access to oil at a reasonable price. One mechanism that could be explored would entail the U.S. committing to sell oil from its strategic petroleum reserve at a discount from world prices to buffer the impact of the loss of Iranian oil on those countries. Although such an approach is not assured to produce the commitment to such a sanctions regime, should it become necessary, it could constitute a step in that direction.

Beyond diplomacy, the policy options involved become much less pleasant. One such option would constitute the construction of a credible deterrent e.g., in the form of a U.S. commitment that would translate into Iran’s destruction were Iran to launch or attempt a nuclear strike and/or proliferate nuclear weapons. Even then, the Middle East’s balance of power would be dramatically altered on dimensions concerning state power, the capabilities of non-state actors, and in terms of the Sunni-Shia rivalry. Another option would entail military strikes. Such strikes would likely be costly considering the need for some ground component to destroy buried nuclear facilities and risk of retaliation by Iran and its proxies (Hamas and Hezbollah). Such strikes might only briefly delay Iran’s attaining a nuclear weapons capacity, especially if Iran has additional hidden facilities.

Therefore, given tradeoffs involved were diplomacy to fail, it makes sense to put the pieces in place to maximize the prospects of diplomatic success keeping in mind that a diplomatic breakthrough would need to accommodate the core needs of all parties. In principle, a diplomatic breakthrough would probably allow Iran an ability to maintain a civil nuclear energy industry (Iran’s core need) subject to an intrusive verification regime (the international community’s core need in minimizing the risk of nuclear proliferation). A truly rigorous sanctions regime that targets Iran’s oil industry would probably be key to facilitating the negotiating process should Iran take an implacable stand. An oil-sharing agreement to shield leading importers of Iranian oil from the impact of such a sanctions regime would probably strengthen prospects of building such a sanctions regime.

&&

Labels:

China,

diplomacy,

Iran,

negotiations,

nuclear,

oil-sharing,

strategic petroleum reserve,

United States

Wednesday, September 23, 2009

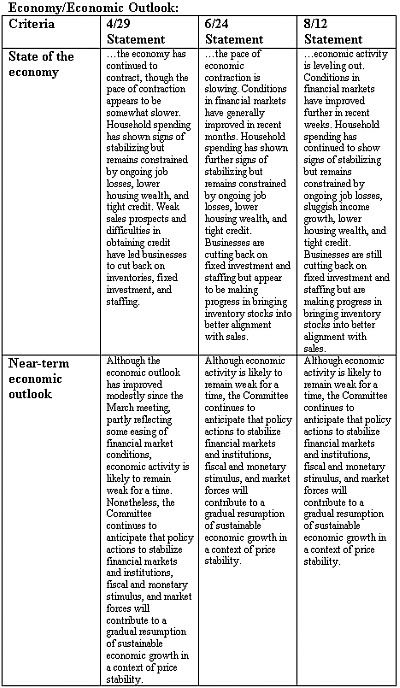

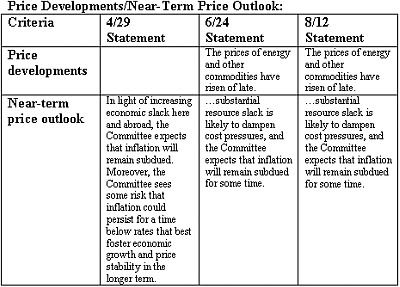

Fed Sees Economy Beginning to Strengthen

Today, the Federal Reserve’s Federal Open Market Committee (FOMC) left interest rates unchanged. However, the statement explaining its decision indicated that the Federal Reserve now sees the economy in its early stages of strengthening. The Fed has also taken a slightly more robust perspective on near-term economic growth, shifting its language from “a gradual resumption of sustainable economic growth” to “a strengthening of economic growth.” In addition, the FOMC somewhat toned down the language on the Fed’s efforts to promote an economic recovery and maintain price stability. With respect to its extraordinary programs, the Federal Reserve remains on course to end its purchases of Treasury securities in October. In addition, it will extend its purchases of agency mortgage-backed securities and agency debt through the first quarter of 2010. However, it will not expand those programs beyond the earlier announced parameters. The extension of the period during which the Fed will be purchasing such securities has likely been implemented to avoid a sharp cut off of the program.

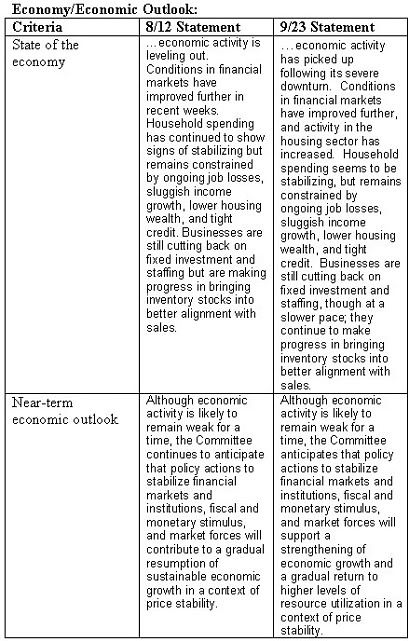

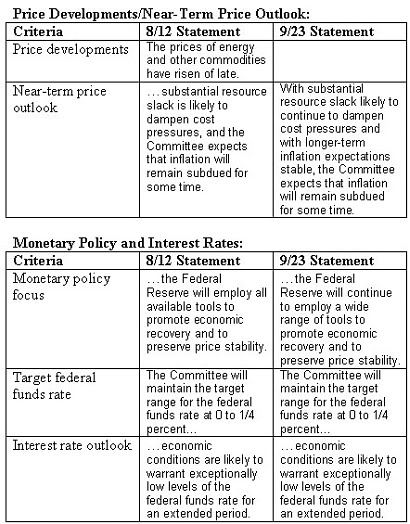

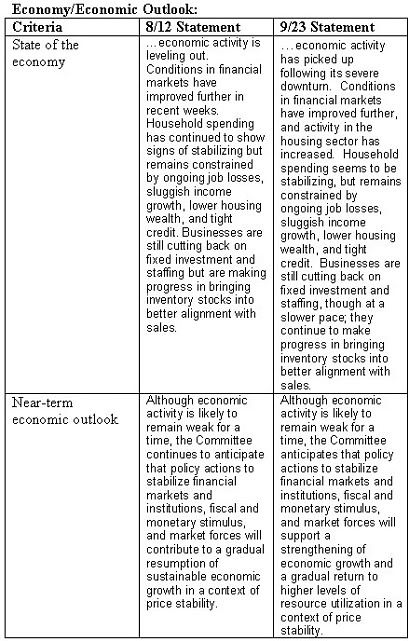

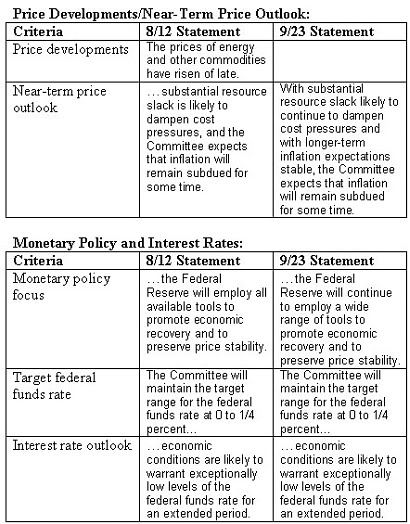

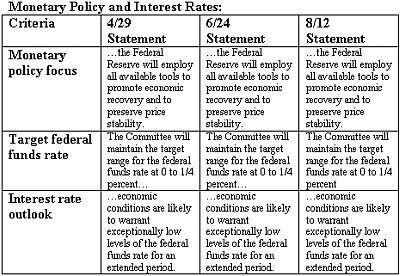

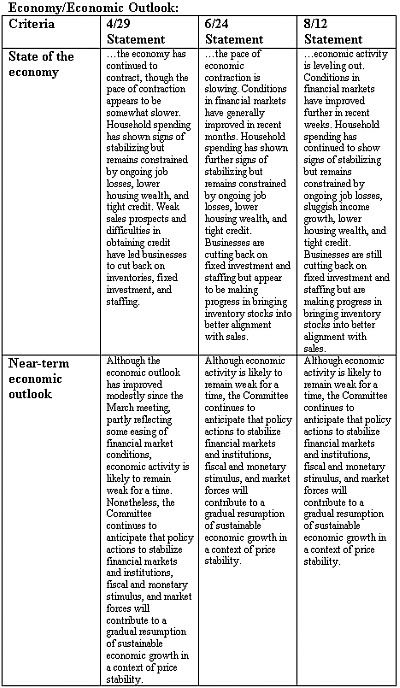

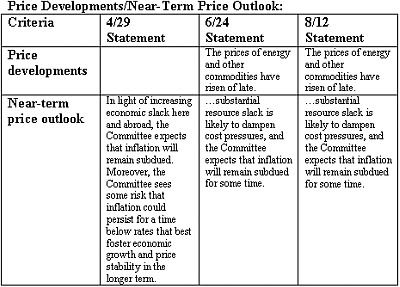

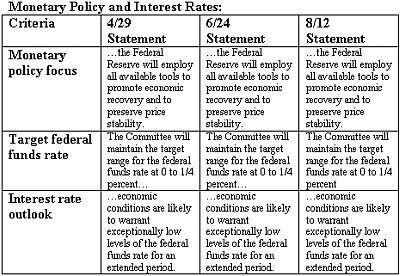

The following tables compare the FOMC’s August 12 and September 23 monetary policy statements so as to show the continuing evolution of the Fed’s thinking:

&&

The following tables compare the FOMC’s August 12 and September 23 monetary policy statements so as to show the continuing evolution of the Fed’s thinking:

&&

Wednesday, September 16, 2009

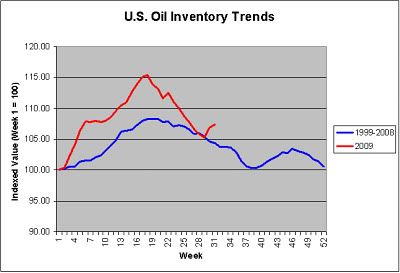

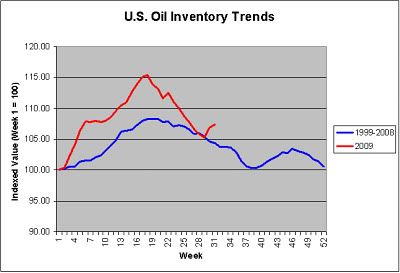

U.S. Crude Oil Inventories Continue to Fall

U.S. Crude Oil Inventories Continue to Fall

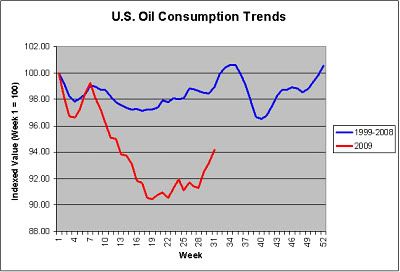

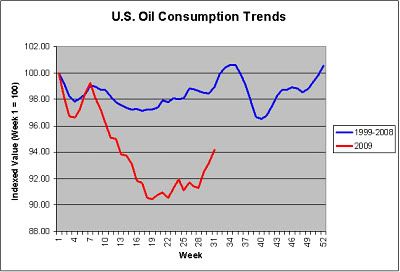

Consistent with recent seasonality and an emergent economic recovery, U.S. crude oil inventories declined for the forth time in five weeks. The U.S. Energy Information Administration reported that U.S. crude oil inventories had fallen to 332.8 million barrels for the four-week period ended September 11, 2009. All said, U.S. crude oil inventories are now 5.5% lower than the 352.0 million figure for the four-week period ended August 7, 2009. During the same period, U.S. crude oil consumption has increased 2.9%.

With OPEC having decided to leave its production goals unchanged in its most recent meeting, the U.S. and major international economies showing signs of stabilizing or emergent growth, and seasonality continuing to prevail, these developments will very likely preclude a collapse in the price of crude oil predicted by one analyst this year. Instead, oil market fundamentals continue to suggest that any declines would be far shallower. With some recent computer guidance suggesting a possibly colder than normal heating season for populated areas in North America, an increase in crude oil prices as the heating season approaches or commences is plausible.

&&

Consistent with recent seasonality and an emergent economic recovery, U.S. crude oil inventories declined for the forth time in five weeks. The U.S. Energy Information Administration reported that U.S. crude oil inventories had fallen to 332.8 million barrels for the four-week period ended September 11, 2009. All said, U.S. crude oil inventories are now 5.5% lower than the 352.0 million figure for the four-week period ended August 7, 2009. During the same period, U.S. crude oil consumption has increased 2.9%.

With OPEC having decided to leave its production goals unchanged in its most recent meeting, the U.S. and major international economies showing signs of stabilizing or emergent growth, and seasonality continuing to prevail, these developments will very likely preclude a collapse in the price of crude oil predicted by one analyst this year. Instead, oil market fundamentals continue to suggest that any declines would be far shallower. With some recent computer guidance suggesting a possibly colder than normal heating season for populated areas in North America, an increase in crude oil prices as the heating season approaches or commences is plausible.

&&

Wednesday, September 9, 2009

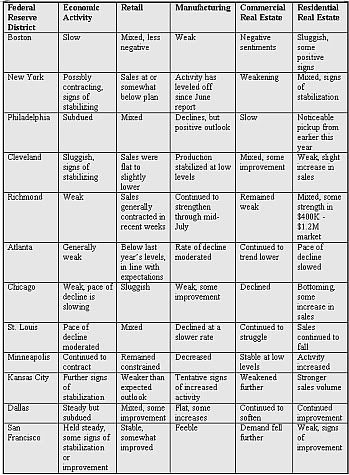

Beige Book: Continuing Economic Stabilization

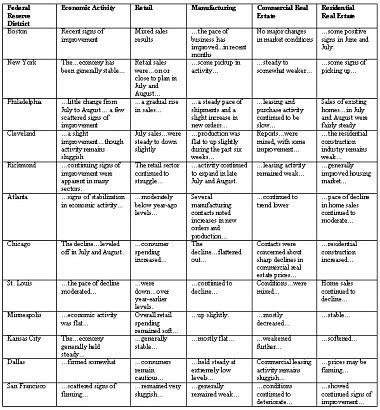

Earlier today, the Federal Reserve released its Beige Book on economic conditions around the nation. The report showed continued stabilization of the overall economy with some indications of improvement. Nevertheless, numerous sectors remained weak.

A table summarizing the report follows:

&&

A table summarizing the report follows:

&&

Friday, August 28, 2009

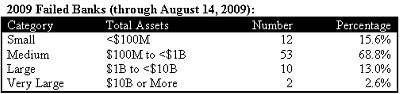

Bank Failure Snapshot

This evening, the FDIC announced the failure of Baltimore-based Bradford Bank. Bradford is the 82nd bank to fail this year. Since the housing bubble burst, 110 banks have failed. Total assets for those failed banks amount to $465 billion.

Some quick statistics follow:

In addition, three states account for 51 bank failures or 46% of the total to date:

Georgia: 24

Illinois: 14

California: 13

In sum, a quick snapshot reveals:

• The overwhelming majority (79%) of failed banks are small or medium-sized banks.

• The incidence of bank failures has increased markedly during the summer, with July and August accounting for 45% of this year’s failed banks.

• Bank failures have clustered in select states.

&&

Some quick statistics follow:

In addition, three states account for 51 bank failures or 46% of the total to date:

Georgia: 24

Illinois: 14

California: 13

In sum, a quick snapshot reveals:

• The overwhelming majority (79%) of failed banks are small or medium-sized banks.

• The incidence of bank failures has increased markedly during the summer, with July and August accounting for 45% of this year’s failed banks.

• Bank failures have clustered in select states.

&&

Thursday, August 27, 2009

Basel Committee on Banking Supervision Issues Principles for Financial Instrument Accounting Standards

Today, the Basel Committee on Banking Supervision issued a set of principles aimed at guiding the International Accounting Standards Board (IASB) in addressing issues concerning the fair value of financial assets.

Based on the principles, a new accounting standard should:

• reflect the need for earlier recognition of loan losses to ensure robust provisions;

• recognize that fair value is not effective when markets become dislocated or are illiquid.

• permit reclassifications from the fair value to the amortized cost category; which should be allowed in rare circumstances following the occurrence of events having clearly led to a change in the business model;

• promote a level playing field across jurisdictions.

The Basel Committee also noted:

To address particular concerns about procyclicality, the new standards should provide for valuation adjustments to avoid misstatement of both initial and subsequent profit and loss recognition when there is significant valuation uncertainty. Moreover, loan loss provisions should be robust and based on sound methodologies that reflect expected credit losses in the banks’ existing loan portfolio over the life of the portfolio.

&&

Based on the principles, a new accounting standard should:

• reflect the need for earlier recognition of loan losses to ensure robust provisions;

• recognize that fair value is not effective when markets become dislocated or are illiquid.

• permit reclassifications from the fair value to the amortized cost category; which should be allowed in rare circumstances following the occurrence of events having clearly led to a change in the business model;

• promote a level playing field across jurisdictions.

The Basel Committee also noted:

To address particular concerns about procyclicality, the new standards should provide for valuation adjustments to avoid misstatement of both initial and subsequent profit and loss recognition when there is significant valuation uncertainty. Moreover, loan loss provisions should be robust and based on sound methodologies that reflect expected credit losses in the banks’ existing loan portfolio over the life of the portfolio.

&&

Wednesday, August 26, 2009

Seniors’ Health Care Bill of Rights Fails to Satisfy Key Criteria for Credible Health Reform

As outlined in previous blog entries, arguably the most important criteria any credible health care reform initiative would need to satisfy are:

• The initiative would need to be budget-neutral.

• The reform would need to materially slow the annual growth in national health care expenditures.

• The legislation would need to provide a mechanism that significantly reduces the number of uninsured persons.

At the conclusion of its Chapter IV Consultations with the United States, the International Monetary Fund (IMF) noted, in part:

Directors underscored that addressing soaring entitlement costs remains the critical medium-term fiscal challenge… [T]he ultimate package should include substantial measures to reduce health care costs over the longer term, while aiming at budget neutrality in the short term. Directors underscored that the impact of cost control measures will need to be carefully monitored, and that additional measures should be taken promptly as needed.

To date, the Congressional Budget Office (CBO) has found that emerging reform proposals are not budget neutral and they do not bring about a material reduction in the rate at which national health care expenditures have been growing.

On August 24, 2009, Republican National Committee Chairman Michael Steele unveiled a “Seniors’ Health Care Bill of Rights” as an alternative to emerging Congressional packages. Accompanying the concept was an op-ed piece published in that day’s edition of The Washington Post. Together, the conceptual outline and op-ed piece offer a sketch of broader alternative health care reform ideas that are beginning to emerge. However, as was the case with the Congressional initiatives, the alternative ideas also fail to meet the criteria set forth at the beginning of this blog entry.

A closer look at the Steele concept relevant to the aforementioned criteria follows:

Budget Neutrality: In the op-ed piece, Steele writes, “We also believe that any health-care reform should be fully paid for, but not funded on the backs of our nation's senior citizens.” The conceptual outline offers no specific spending reductions or tax increases that would finance health care reform. Consistent with Republican Party principles, tax hikes are likely to be off the table. Therefore, implicit in the concept is the possibility that all spending reductions for health care reform would need to be taken from discretionary spending or that health care reform would have to be shelved altogether.

The former possibility is unlikely to fully finance health care reform that dramatically reduces the incidence of insured persons. As the Steele concept leaves Medicare on auto-pilot and rules out benefit reductions, the rising costs of Medicare could devour an increasing share of discretionary spending, leaving little or nothing for financing any sustainable health care reform initiative. Furthermore, political consensus to achieve increasingly deep discretionary spending cuts is highly unlikely over the longer-term, even as the magnitude of necessary discretionary budget reductions under the Steele approach would grow. Yet, even if health care reform is canceled, the need for health care reform, particularly as the incidence of uninsured persons persists and excess rise in national health care expenditures continues, would grow more urgent.

Slowing the Excess Rise in National Health Care Expenditures: The concept would rule out cuts in Medicare spending. No mention is made about slowing the growth of Medicare spending either. In contrast, even as the Clinton Administration and Republican-led Congress struggled over Medicare reform during the mid-1990s, both sides were in agreement that the rate at which Medicare spending was growing needed to be slowed. Behind the rise in Medicare spending is the slowly shifting demographic mix and health care inflation. Unless health care inflation is tamed—and increasing health industry productivity and focusing on rising hospital-related costs, which have been the principal driver of medical cost inflation could be essential to that task—Medicare expenditures will continue to increase faster than the economy grows. In the long-run, that is a fiscally unsustainable situation.

Significant Reduction in the Incidence of Uninsured Persons: The concept unveiled by Steele is intended to be a starting point for health care reform. It does not address the measures or mechanisms that would be offered to reduce the incidence of uninsured persons.

In sum, even as Steele asserts, “Republicans want reform that should, first, do no harm,” a failure to address Medicare’s long-term fiscal imbalances, which depends in large part on slowing the annual growth in national health expenditures, will inflict growing damage to the nation’s long-term fiscal outlook. Already, the perpetual horizon unfunded liability associated with Medicare amounts to $85.6 trillion. According to Dallas Federal Reserve President Richard Fisher, 97% of discretionary spending, which includes national defense and education spending, would need to be eliminated to finance the nation’s long-term fiscal imbalances associated with Social Security and Medicare. No such stark decision would be politically-feasible. Hence, far from doing “no harm,” a failure to grapple with the fundamental issue of rising health expenditures, which all but certainly will require a mix of revenue increases and benefit reductions, would do great harm.

&&

• The initiative would need to be budget-neutral.

• The reform would need to materially slow the annual growth in national health care expenditures.

• The legislation would need to provide a mechanism that significantly reduces the number of uninsured persons.

At the conclusion of its Chapter IV Consultations with the United States, the International Monetary Fund (IMF) noted, in part:

Directors underscored that addressing soaring entitlement costs remains the critical medium-term fiscal challenge… [T]he ultimate package should include substantial measures to reduce health care costs over the longer term, while aiming at budget neutrality in the short term. Directors underscored that the impact of cost control measures will need to be carefully monitored, and that additional measures should be taken promptly as needed.

To date, the Congressional Budget Office (CBO) has found that emerging reform proposals are not budget neutral and they do not bring about a material reduction in the rate at which national health care expenditures have been growing.

On August 24, 2009, Republican National Committee Chairman Michael Steele unveiled a “Seniors’ Health Care Bill of Rights” as an alternative to emerging Congressional packages. Accompanying the concept was an op-ed piece published in that day’s edition of The Washington Post. Together, the conceptual outline and op-ed piece offer a sketch of broader alternative health care reform ideas that are beginning to emerge. However, as was the case with the Congressional initiatives, the alternative ideas also fail to meet the criteria set forth at the beginning of this blog entry.

A closer look at the Steele concept relevant to the aforementioned criteria follows:

Budget Neutrality: In the op-ed piece, Steele writes, “We also believe that any health-care reform should be fully paid for, but not funded on the backs of our nation's senior citizens.” The conceptual outline offers no specific spending reductions or tax increases that would finance health care reform. Consistent with Republican Party principles, tax hikes are likely to be off the table. Therefore, implicit in the concept is the possibility that all spending reductions for health care reform would need to be taken from discretionary spending or that health care reform would have to be shelved altogether.

The former possibility is unlikely to fully finance health care reform that dramatically reduces the incidence of insured persons. As the Steele concept leaves Medicare on auto-pilot and rules out benefit reductions, the rising costs of Medicare could devour an increasing share of discretionary spending, leaving little or nothing for financing any sustainable health care reform initiative. Furthermore, political consensus to achieve increasingly deep discretionary spending cuts is highly unlikely over the longer-term, even as the magnitude of necessary discretionary budget reductions under the Steele approach would grow. Yet, even if health care reform is canceled, the need for health care reform, particularly as the incidence of uninsured persons persists and excess rise in national health care expenditures continues, would grow more urgent.

Slowing the Excess Rise in National Health Care Expenditures: The concept would rule out cuts in Medicare spending. No mention is made about slowing the growth of Medicare spending either. In contrast, even as the Clinton Administration and Republican-led Congress struggled over Medicare reform during the mid-1990s, both sides were in agreement that the rate at which Medicare spending was growing needed to be slowed. Behind the rise in Medicare spending is the slowly shifting demographic mix and health care inflation. Unless health care inflation is tamed—and increasing health industry productivity and focusing on rising hospital-related costs, which have been the principal driver of medical cost inflation could be essential to that task—Medicare expenditures will continue to increase faster than the economy grows. In the long-run, that is a fiscally unsustainable situation.

Significant Reduction in the Incidence of Uninsured Persons: The concept unveiled by Steele is intended to be a starting point for health care reform. It does not address the measures or mechanisms that would be offered to reduce the incidence of uninsured persons.

In sum, even as Steele asserts, “Republicans want reform that should, first, do no harm,” a failure to address Medicare’s long-term fiscal imbalances, which depends in large part on slowing the annual growth in national health expenditures, will inflict growing damage to the nation’s long-term fiscal outlook. Already, the perpetual horizon unfunded liability associated with Medicare amounts to $85.6 trillion. According to Dallas Federal Reserve President Richard Fisher, 97% of discretionary spending, which includes national defense and education spending, would need to be eliminated to finance the nation’s long-term fiscal imbalances associated with Social Security and Medicare. No such stark decision would be politically-feasible. Hence, far from doing “no harm,” a failure to grapple with the fundamental issue of rising health expenditures, which all but certainly will require a mix of revenue increases and benefit reductions, would do great harm.

&&

Tuesday, August 25, 2009

IMF Research Director Outlines Challenges to Sustaining a Global Recovery

Recently, International Monetary Fund (IMF) Economic Counsellor and Director of Research Olivier Blanchard opined that a global economic recovery had commenced, but that sustaining it could require “delicate rebalancing” during which public fiscal stimulus spending is phased out and private demand replaces public demand, and during which large trade imbalances that had previously persisted moderate. In his assessment, Blanchard highlighted supply-side issues, demand-side issues, and risks associated with a failure to rebalance effectively.

A summary of those issues follows:

Supply-Side Issues:

• Partly dysfunctional financial systems in the advanced countries.

• Capital flows to developing countries that decreased may take a few years to fully recover.

• In nearly all countries, the costs of the crisis have exacerbated the fiscal burden and tax hikes may be necessary.

Demand-Side Issues:

• A return of economic growth in 2009 may not be sufficiently strong to reduce unemployment leading to a peak in the unemployment rate in 2010.

• Initial growth will depend mainly on inventory rebuilding and the fiscal stimulus, not private consumption and fixed investment spending. When the fiscal stimulus is unwound and inventory rebuilding is completed, rebalancing will be required to sustain economic growth.

Risks Associated With A Failure to Rebalance Effectively:

• An anemic U.S. recovery.

• Possible efforts to extend the fiscal stimulus. Premature phasing out of the stimulus would undermine economic growth. Extension of the stimulus could lead to concerns about U.S. debt, sparking large capital outflows from the U.S. and a potentially disorderly decline in the U.S. dollar. In turn, that additional instability or uncertainty concerning such instability could derail an economic recovery.

&&

A summary of those issues follows:

Supply-Side Issues:

• Partly dysfunctional financial systems in the advanced countries.

• Capital flows to developing countries that decreased may take a few years to fully recover.

• In nearly all countries, the costs of the crisis have exacerbated the fiscal burden and tax hikes may be necessary.

Demand-Side Issues:

• A return of economic growth in 2009 may not be sufficiently strong to reduce unemployment leading to a peak in the unemployment rate in 2010.

• Initial growth will depend mainly on inventory rebuilding and the fiscal stimulus, not private consumption and fixed investment spending. When the fiscal stimulus is unwound and inventory rebuilding is completed, rebalancing will be required to sustain economic growth.

Risks Associated With A Failure to Rebalance Effectively:

• An anemic U.S. recovery.

• Possible efforts to extend the fiscal stimulus. Premature phasing out of the stimulus would undermine economic growth. Extension of the stimulus could lead to concerns about U.S. debt, sparking large capital outflows from the U.S. and a potentially disorderly decline in the U.S. dollar. In turn, that additional instability or uncertainty concerning such instability could derail an economic recovery.

&&

Monday, August 24, 2009

Bernanke at Jackson Hole: 1999 Paper Remains Relevant

At the Kansas City Federal Reserve’s annual economic symposium at Jackson Hole, Wyoming, Federal Reserve Chairman Ben Bernanke provided a sketch of last year’s financial panic, laid out an account on how the contagion rippled through the financial system, discussed the importance of good liquidity management for the financial sector, and reaffirmed the central bank’s role as a lender of last resort. Noteworthy as that address was, the paper he and Mark Gertler presented at the 1999 symposium remains relevant for some of the lessons it provides.

Some highlights follow:

• Two possible sources of “non-fundamental” fluctuations in asset prices involve “poor regulatory practice” and “imperfect rationality on the part of investors.” There is evidence that financial liberalization that led to poor regulatory practices led to asset price booms in Japan in the 1980s, Scandinavia in the 1990s, among other places. Often financial liberalization led to large capital inflows. Research by Charles Kindleberger revealed that a large proportion of such inflows was allocated to financial investments, touching off a rapid rise in asset prices.

• Problems arise when financial liberalization is not coordinated with the regulatory safety net. Examples of the regulatory safety net include bank deposit insurance and a central bank’s lender-of-last-resort commitments. In such cases, excessive risk-taking can unfold. Bernanke and Gertler explained, “If liberalization gives additional power to private lenders and borrowers while retaining government guarantees of liabilities, excessive risk-taking and speculation will follow, leading, in many cases, to asset-price booms.” Bernanke and Gertler added that this development characterized “reasonably” the S&L crisis in the U.S., the financial crisis in Japan following the collapse of its real estate and stock market bubbles, and the Asian financial crisis, among others.

• Asset prices have an impact on the real economy. The most important connection between asset prices and the real economy is through the balance sheet channel. Cash flows and balance sheet strength are important determinants of agents’ lending and borrowing capacity. The balance sheet channel helps explain the “financial accelerator” effect under which macroeconomic activity strengthens during a rapid rise in asset prices. It also helps explain the slowdown, and sometimes, debt-deflation mechanism, that develops following a sharp contraction in asset prices.

As a caveat, it should be noted that there is significant disagreement on the issue of whether monetary policy should respond aggressively to potential asset bubbles, particularly real estate bubbles that involve large amounts of leverage. The Bernanke-Gertler paper argued against intervention when it came to stock market bubbles. It did not address real estate bubbles. The paper asserted that when monetary policy aggressively targets consumer and producer inflation, “whether policy also responds independently to stock prices is not of great consequence.” In contrast, in recent years, the International Monetary Fund has increasingly called for greater consideration of asset prices in the rubric of inflation measurements.

Nevertheless, in the end, the Bernanke-Gertler paper offers policy makers some important guidance in developing a post-financial crisis regulatory framework. Most importantly, policy makers will need to ensure that the regulatory regime is compatible with the regulatory safety net. As a corollary, policy makers will need to take steps to ensure that the extraordinary intervention during the financial crisis will not breed the kind of moral hazard that could fuel a fresh wave of excessive risk-taking in the near- or medium-term. One key to such an approach would entail addressing the “too big to fail” issue. If that issue is resolved, then the extraordinary intervention would be perceived as a rare exception, not the norm of what could be expected should a future crisis erupt.

For now, even as prospective regulatory reforms have been introduced, the overall process is still in its early stages. For that reason, the 1999 Bernanke-Gertler paper can offer policy makers some valuable guidance as they pursue regulatory reform.

&&

Some highlights follow:

• Two possible sources of “non-fundamental” fluctuations in asset prices involve “poor regulatory practice” and “imperfect rationality on the part of investors.” There is evidence that financial liberalization that led to poor regulatory practices led to asset price booms in Japan in the 1980s, Scandinavia in the 1990s, among other places. Often financial liberalization led to large capital inflows. Research by Charles Kindleberger revealed that a large proportion of such inflows was allocated to financial investments, touching off a rapid rise in asset prices.

• Problems arise when financial liberalization is not coordinated with the regulatory safety net. Examples of the regulatory safety net include bank deposit insurance and a central bank’s lender-of-last-resort commitments. In such cases, excessive risk-taking can unfold. Bernanke and Gertler explained, “If liberalization gives additional power to private lenders and borrowers while retaining government guarantees of liabilities, excessive risk-taking and speculation will follow, leading, in many cases, to asset-price booms.” Bernanke and Gertler added that this development characterized “reasonably” the S&L crisis in the U.S., the financial crisis in Japan following the collapse of its real estate and stock market bubbles, and the Asian financial crisis, among others.

• Asset prices have an impact on the real economy. The most important connection between asset prices and the real economy is through the balance sheet channel. Cash flows and balance sheet strength are important determinants of agents’ lending and borrowing capacity. The balance sheet channel helps explain the “financial accelerator” effect under which macroeconomic activity strengthens during a rapid rise in asset prices. It also helps explain the slowdown, and sometimes, debt-deflation mechanism, that develops following a sharp contraction in asset prices.

As a caveat, it should be noted that there is significant disagreement on the issue of whether monetary policy should respond aggressively to potential asset bubbles, particularly real estate bubbles that involve large amounts of leverage. The Bernanke-Gertler paper argued against intervention when it came to stock market bubbles. It did not address real estate bubbles. The paper asserted that when monetary policy aggressively targets consumer and producer inflation, “whether policy also responds independently to stock prices is not of great consequence.” In contrast, in recent years, the International Monetary Fund has increasingly called for greater consideration of asset prices in the rubric of inflation measurements.

Nevertheless, in the end, the Bernanke-Gertler paper offers policy makers some important guidance in developing a post-financial crisis regulatory framework. Most importantly, policy makers will need to ensure that the regulatory regime is compatible with the regulatory safety net. As a corollary, policy makers will need to take steps to ensure that the extraordinary intervention during the financial crisis will not breed the kind of moral hazard that could fuel a fresh wave of excessive risk-taking in the near- or medium-term. One key to such an approach would entail addressing the “too big to fail” issue. If that issue is resolved, then the extraordinary intervention would be perceived as a rare exception, not the norm of what could be expected should a future crisis erupt.

For now, even as prospective regulatory reforms have been introduced, the overall process is still in its early stages. For that reason, the 1999 Bernanke-Gertler paper can offer policy makers some valuable guidance as they pursue regulatory reform.

&&

Friday, August 21, 2009

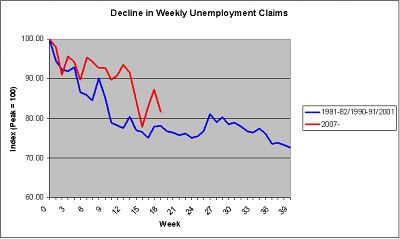

Initial Weekly Unemployment Claims Rise to 576,000

Yesterday, the Department of Labor reported that initial weekly unemployment claims rose to 576,000. That marked the second consecutive weekly increase. The figure came in above both the consensus forecast of 550,000 and the highest estimate among economists of 559,000. In addition, the four-week moving average for initial weekly unemployment claims rose 4,250 to 570,000.

Although it is still a little too soon to suggest that a fresh increase is now underway, past recessions have typically seen initial weekly unemployment claims rise anew for a time before finally falling off to levels compatible with net job creation.

Given past historic experience, not to mention the dynamics associated with the current recession, the following still appears likely:

• A period during which weekly unemployment claims rise anew, perhaps approaching or reaching 600,000 during one or two weeks.

• A persistence of initial weekly unemployment claims remaining at or above 500,000, for most of the rest of this year, though some fluctuations below 500,000 are possible.

• A low possibility that weekly unemployment claims could fall to 450,000 toward the end of the year.

• A continuing rise in the national unemployment rate from 9.4% through the rest of this year, though minor fluctuations with some small dips are also possible ahead of the peak unemployment rate.

&&

Although it is still a little too soon to suggest that a fresh increase is now underway, past recessions have typically seen initial weekly unemployment claims rise anew for a time before finally falling off to levels compatible with net job creation.

Given past historic experience, not to mention the dynamics associated with the current recession, the following still appears likely:

• A period during which weekly unemployment claims rise anew, perhaps approaching or reaching 600,000 during one or two weeks.

• A persistence of initial weekly unemployment claims remaining at or above 500,000, for most of the rest of this year, though some fluctuations below 500,000 are possible.

• A low possibility that weekly unemployment claims could fall to 450,000 toward the end of the year.

• A continuing rise in the national unemployment rate from 9.4% through the rest of this year, though minor fluctuations with some small dips are also possible ahead of the peak unemployment rate.

&&

Thursday, August 20, 2009

Despite Analyst’s Opinion, Inflation Fears Are Not Behind the Current Oil Price

On August 19, 2009, CNBC reported:

The price of oil could slump toward $20 as the fundamentals supporting it are still extremely weak and its currently only being held up by fear of inflation, Johannes Benigni, managing director at JBC Energy, told CNBC.

"People are scared of inflation, that's why they are buying oil and other commodities…," Benigni said.

Although the price of crude oil may be running above levels implied by fundamentals such as global consumption and global crude oil stocks, and such a situation would be consistent with the tendency for markets to overshoot, survey and swaps data indicate that inflation concerns are not the explanation for current oil prices.

• The median expected increase in prices over the July 2009-July 2010 timeframe in the University of Michigan survey of consumers was 2.9%. That was down from the previous month’s figure of 3.1%.

• U.S. Dollar Inflation Zero Coupon securities also paint a picture of low, tame inflation. The 1-year, 2-year, and 5-year figures on August 19 were 1.23%, 1.10%, and 1.56% respectively. The 10-year figure was 2.44%. That data suggests that investors are expecting inflation to remain contained in the near- and medium-term, and generally near levels compatible with price stability a decade out.

Finally, if one examines recent news stories concerning recent oil market developments, market psychology rooted in expectations for an improving global economic outlook may be an important driver of crude oil prices. Three recent examples from The Wall Street Journal:

July 24, 2009 edition: “Although the economy is still in a slump, investors were galvanized by a third monthly increase in existing-home sales in June…”

July 31, 2009 edition: “Crude-oil futures shot up, reversing sharp losses from the prior session as rising confidence in an economic recovery displaced concerns about weak oil demand.”

August 4, 2009 edition: “Crude-oil prices settled at a six-week high, as the dollar dropped to its lowest level against the euro this year amid optimism about the outlook for the world economy.”

&&

The price of oil could slump toward $20 as the fundamentals supporting it are still extremely weak and its currently only being held up by fear of inflation, Johannes Benigni, managing director at JBC Energy, told CNBC.

"People are scared of inflation, that's why they are buying oil and other commodities…," Benigni said.

Although the price of crude oil may be running above levels implied by fundamentals such as global consumption and global crude oil stocks, and such a situation would be consistent with the tendency for markets to overshoot, survey and swaps data indicate that inflation concerns are not the explanation for current oil prices.

• The median expected increase in prices over the July 2009-July 2010 timeframe in the University of Michigan survey of consumers was 2.9%. That was down from the previous month’s figure of 3.1%.

• U.S. Dollar Inflation Zero Coupon securities also paint a picture of low, tame inflation. The 1-year, 2-year, and 5-year figures on August 19 were 1.23%, 1.10%, and 1.56% respectively. The 10-year figure was 2.44%. That data suggests that investors are expecting inflation to remain contained in the near- and medium-term, and generally near levels compatible with price stability a decade out.

Finally, if one examines recent news stories concerning recent oil market developments, market psychology rooted in expectations for an improving global economic outlook may be an important driver of crude oil prices. Three recent examples from The Wall Street Journal:

July 24, 2009 edition: “Although the economy is still in a slump, investors were galvanized by a third monthly increase in existing-home sales in June…”

July 31, 2009 edition: “Crude-oil futures shot up, reversing sharp losses from the prior session as rising confidence in an economic recovery displaced concerns about weak oil demand.”

August 4, 2009 edition: “Crude-oil prices settled at a six-week high, as the dollar dropped to its lowest level against the euro this year amid optimism about the outlook for the world economy.”

&&

Wednesday, August 19, 2009

Oil Market Update: U.S. Crude Oil Stocks Fall Sharply

Today, the U.S. Energy Information Administration (EIA) reported that U.S. crude oil inventories plunged 8.4 million barrels to 343.6 million barrels for the four-week period ended August 14.

Overall, the decline in inventories is in line with expectations laid out in the August 6 blog entry. Highlights from that entry were:

U.S. oil consumption has continued to follow broad seasonal patterns albeit with a noticeably sharper falloff between winter heating season and the summer driving season.

If one transposes this year’s trends relative to the 10-year base, the recent uptick in oil inventories was not too surprising. However, assuming that this year’s dynamics remain relatively constant, oil inventories are not likely to rise significantly in coming weeks. Instead, the more normal pattern of falling inventories until sometime in mid- to late-September should resume.

The dynamics that have prevailed so far this year would suggest an initial peak near 350 million barrels before a fresh decline in inventories commences.

Aside from rising oil consumption (now 18.995 million barrels per day, the highest figure since the four-week period ended March 20, 2009 when consumption averaged 19.112 million barrels per day), a substantial drop in oil imports likely produced the sharp decline in inventories. The four-week period ended August 14, saw imports average 9.662 million barrels per day. The prior four-week period had average daily imports of 10.087 million barrels.

Overall, my thinking remains essentially unchanged from August 6. In my opinion, oil inventories should ultimately fall to just below 340 million barrels in coming weeks. A 1-2- standard deviation move below the patterns that have prevailed this year would bring oil inventories to as low as 324 million to 331 million barrels before the autumnal rise in crude stocks begins some time in September.

&&

Overall, the decline in inventories is in line with expectations laid out in the August 6 blog entry. Highlights from that entry were:

U.S. oil consumption has continued to follow broad seasonal patterns albeit with a noticeably sharper falloff between winter heating season and the summer driving season.

If one transposes this year’s trends relative to the 10-year base, the recent uptick in oil inventories was not too surprising. However, assuming that this year’s dynamics remain relatively constant, oil inventories are not likely to rise significantly in coming weeks. Instead, the more normal pattern of falling inventories until sometime in mid- to late-September should resume.

The dynamics that have prevailed so far this year would suggest an initial peak near 350 million barrels before a fresh decline in inventories commences.

Aside from rising oil consumption (now 18.995 million barrels per day, the highest figure since the four-week period ended March 20, 2009 when consumption averaged 19.112 million barrels per day), a substantial drop in oil imports likely produced the sharp decline in inventories. The four-week period ended August 14, saw imports average 9.662 million barrels per day. The prior four-week period had average daily imports of 10.087 million barrels.

Overall, my thinking remains essentially unchanged from August 6. In my opinion, oil inventories should ultimately fall to just below 340 million barrels in coming weeks. A 1-2- standard deviation move below the patterns that have prevailed this year would bring oil inventories to as low as 324 million to 331 million barrels before the autumnal rise in crude stocks begins some time in September.

&&

Scholes: Bring Transparency to Banks’ Illiquid Assets

On Tuesday, Nobel Prize winning economist Myron Scholes asserted that banks should provide fair value estimates for their illiquid assets. To do so, he urged that banks shift more of their illiquid assets to exchanges and expand mark-to-market accounting. Currently, the Financial Accounting Standards Board is considering whether to expand its fair-value rules to bank loans.

If implemented, Scholes’ recommendation would constitute an important step toward greater transparency, more timely reporting, and more credible information. In theory, armed with improved assessments of the value of a financial institution’s assets, investors would be able to make better capital allocation decisions. In turn, better capital allocation decision making should lead to improved macroeconomic outcomes over the long-run.

In his book, The Roaring Nineties (W. W. Norton & Company, 2003), Columbia University economics professor Joseph Stiglitz explained the linkage between capital allocation and macroeconomic outcomes as follows:

When share prices reflect bad information, resources are likely to be badly deployed. In the late nineties, they were very badly deployed. Rising prices say, “invest more.” The fast-rising prices of tech and telecommunications stocks led to an enormous overhang of investment in those sectors of the economy. That overhang, in turn, was partly responsible for the long downturn that began in late 2000. And it all started with ill-advised accounting practices…

For a market economy to function well, all the participants must have confidence in it. Investors and potential investors need to believe that there is a level playing field, with accurate information, rather than a rigged game in which insiders are bound to win.

Additional measures that could reduce the problem of asymmetric information—information that is not possessed at the same time by all market participants—would include:

• Expensing of stock options. Ultimately, stock options have a dilutive impact on shareholder wealth. Expensing would allow shareholders to better assess the costs and benefits of such options.

• A dramatic reduction of off-balance sheet items. The practice of shifting potentially significant items off the balance sheet tends to make it more difficult for investors to reasonably assess the risk associated with a given firm. With such items having no visible impact on the net worth of a company, management could also be more willing to take larger risks than if the items were reported on the balance sheet.

• A robust strengthening of the conservatism constraint. In other words, when the value of a balance sheet or income statement item is difficult to determine, the firm should adopt the practice that is least likely to overstate income or asset valuations.

• Full disclosure of investment positions. Such disclosure would entail providing gross positions, in addition to netting them out. Henry Kaufman, one of the nation’s leading private sector economists explained in his On Money And Markets: A Wall Street Memoir (McGraw-Hill, 2000), “At times of turmoil, market participants can’t rely on netting plus positions and minus positions with clients. Thus, gross exposures may be the true exposures.”

&&

If implemented, Scholes’ recommendation would constitute an important step toward greater transparency, more timely reporting, and more credible information. In theory, armed with improved assessments of the value of a financial institution’s assets, investors would be able to make better capital allocation decisions. In turn, better capital allocation decision making should lead to improved macroeconomic outcomes over the long-run.

In his book, The Roaring Nineties (W. W. Norton & Company, 2003), Columbia University economics professor Joseph Stiglitz explained the linkage between capital allocation and macroeconomic outcomes as follows:

When share prices reflect bad information, resources are likely to be badly deployed. In the late nineties, they were very badly deployed. Rising prices say, “invest more.” The fast-rising prices of tech and telecommunications stocks led to an enormous overhang of investment in those sectors of the economy. That overhang, in turn, was partly responsible for the long downturn that began in late 2000. And it all started with ill-advised accounting practices…

For a market economy to function well, all the participants must have confidence in it. Investors and potential investors need to believe that there is a level playing field, with accurate information, rather than a rigged game in which insiders are bound to win.

Additional measures that could reduce the problem of asymmetric information—information that is not possessed at the same time by all market participants—would include:

• Expensing of stock options. Ultimately, stock options have a dilutive impact on shareholder wealth. Expensing would allow shareholders to better assess the costs and benefits of such options.

• A dramatic reduction of off-balance sheet items. The practice of shifting potentially significant items off the balance sheet tends to make it more difficult for investors to reasonably assess the risk associated with a given firm. With such items having no visible impact on the net worth of a company, management could also be more willing to take larger risks than if the items were reported on the balance sheet.

• A robust strengthening of the conservatism constraint. In other words, when the value of a balance sheet or income statement item is difficult to determine, the firm should adopt the practice that is least likely to overstate income or asset valuations.

• Full disclosure of investment positions. Such disclosure would entail providing gross positions, in addition to netting them out. Henry Kaufman, one of the nation’s leading private sector economists explained in his On Money And Markets: A Wall Street Memoir (McGraw-Hill, 2000), “At times of turmoil, market participants can’t rely on netting plus positions and minus positions with clients. Thus, gross exposures may be the true exposures.”

&&

Tuesday, August 18, 2009

Fed Lending Survey: Large Banks First to Ease Lending Standards

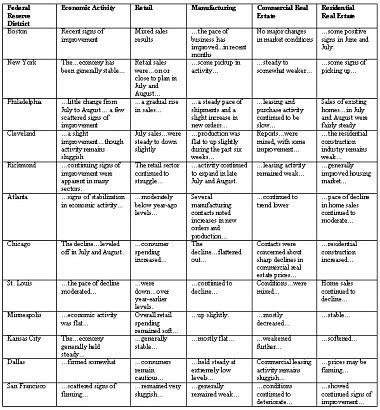

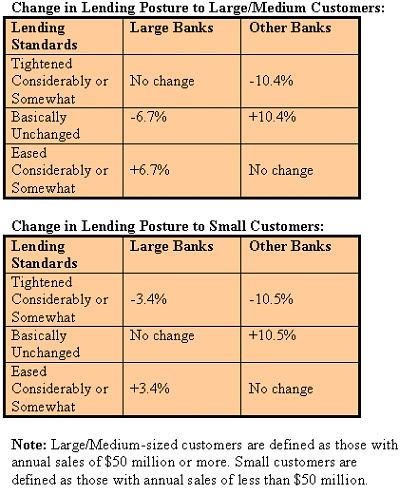

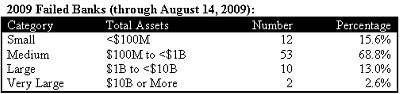

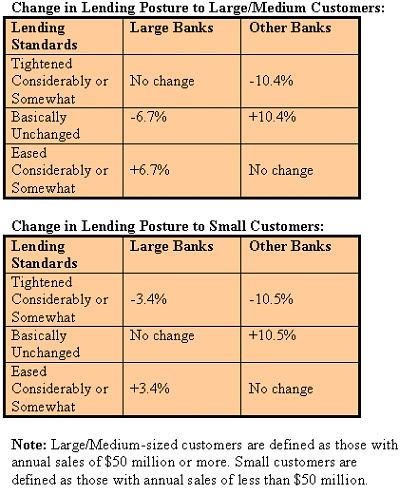

On Monday, the Federal Reserve issued its July 2009 Senior Loan Officer Opinion Survey. Among other things, the survey revealed:

• U.S. banks indicated that they continued to tighten terms of loans to businesses and households.

• U.S. banks suggested that falling demand for loans and deteriorating credit quality were behind a decline in commercial and industrial lending during the Second Quarter.

• U.S. banks pointed to industry-specific problems as a reason for tightening lending standards.

If one compares the July 2009 findings with the earlier April 2009 survey, one finds that a number of large banks somewhat eased their lending standards. No medium- or small-sized banks eased their lending standards.

The current situation in which a number of large banks have led the way in becoming the first institutions to somewhat ease their lending standards may have to do with differing perspectives on risk. The larger institutions may have greater ability to differentiate among customers. They may possess a greater degree of confidence in their ability to weather the continuing fallout of the ongoing recession given their larger resources, greater access to financial markets, and possible perceptions of available federal assistance. The profile of failed banks may also be driving the early divergence in lending posture.

Through August 14, 2009, 77 banks have failed this year. Almost 85% of those banks were small- or medium-sized institutions having assets of less than $1 billion. The median total assets held by banks that failed this year amounted to $271.8 billion.

Following the 2001 recession, small- and medium-sized banks were the first to ease somewhat in August 2002. However, it was not until 2003 that a growing number of banks, led by large institutions, began easing their lending standards. If the past recession offers any insights, most banks are more likely than not to hold lending standards steady or even tighten somewhat over the next 6 months or longer.

&&

• U.S. banks indicated that they continued to tighten terms of loans to businesses and households.

• U.S. banks suggested that falling demand for loans and deteriorating credit quality were behind a decline in commercial and industrial lending during the Second Quarter.

• U.S. banks pointed to industry-specific problems as a reason for tightening lending standards.

If one compares the July 2009 findings with the earlier April 2009 survey, one finds that a number of large banks somewhat eased their lending standards. No medium- or small-sized banks eased their lending standards.

The current situation in which a number of large banks have led the way in becoming the first institutions to somewhat ease their lending standards may have to do with differing perspectives on risk. The larger institutions may have greater ability to differentiate among customers. They may possess a greater degree of confidence in their ability to weather the continuing fallout of the ongoing recession given their larger resources, greater access to financial markets, and possible perceptions of available federal assistance. The profile of failed banks may also be driving the early divergence in lending posture.

Through August 14, 2009, 77 banks have failed this year. Almost 85% of those banks were small- or medium-sized institutions having assets of less than $1 billion. The median total assets held by banks that failed this year amounted to $271.8 billion.

Following the 2001 recession, small- and medium-sized banks were the first to ease somewhat in August 2002. However, it was not until 2003 that a growing number of banks, led by large institutions, began easing their lending standards. If the past recession offers any insights, most banks are more likely than not to hold lending standards steady or even tighten somewhat over the next 6 months or longer.

&&

Monday, August 17, 2009

Hospitals are the Principal Driver of Health Care Inflation

In Friday’s discussion, I noted that statistical data revealed that the largest share of increased national health expenditures can be attributed to medical price inflation. At the same time, the smallest share can be attributed to value added.

As a result, a closer look at health care inflation is in order. Data provided by the U.S. Bureau of Labor Statistics reveals:

• Medical price inflation is not broad-based. Instead, a single sector is the major contributor. Both during the 2000-08 timeframe and during the very recent July 2008-July 2009 period, hospital and related services saw, by far, the largest price hikes.

• Professional services e.g., physician services, saw a slowdown in price increases during the July 2008-July 2009 timeframe, even as consumer prices overall fell.

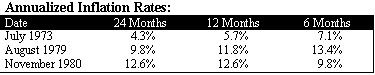

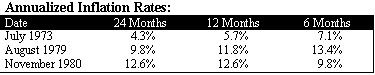

The following tables provide a snapshot of medical price changes and overall changes in consumer prices.

In sum, the key to taming medical price inflation likely depends on a fundamental restructuring of the nation’s hospitals so that the hospitals become more sensitive to overall economic developments and increase their overall productivity. Such a restructuring would entail states and localities making it easier for poorly-run hospitals to fail, better run hospitals to expand across state borders, and international hospitals to enter the U.S. market, among other things.

&&

As a result, a closer look at health care inflation is in order. Data provided by the U.S. Bureau of Labor Statistics reveals:

• Medical price inflation is not broad-based. Instead, a single sector is the major contributor. Both during the 2000-08 timeframe and during the very recent July 2008-July 2009 period, hospital and related services saw, by far, the largest price hikes.

• Professional services e.g., physician services, saw a slowdown in price increases during the July 2008-July 2009 timeframe, even as consumer prices overall fell.

The following tables provide a snapshot of medical price changes and overall changes in consumer prices.

In sum, the key to taming medical price inflation likely depends on a fundamental restructuring of the nation’s hospitals so that the hospitals become more sensitive to overall economic developments and increase their overall productivity. Such a restructuring would entail states and localities making it easier for poorly-run hospitals to fail, better run hospitals to expand across state borders, and international hospitals to enter the U.S. market, among other things.

&&

Friday, August 14, 2009

Low Value-Added May Be Helping Drive Rising Health Expenditures

The August 13, 2009 edition of The Washington Post reported:

Democrats say it will be hard to push a reform bill through Congress unless it reduces projected spending on health care and begins to bring the federal debt under control…

“It's not good enough that it's just paid for; it actually has to start driving long-term costs down,” said Sen. Mark Warner (D-Va.), one of nine freshman Democrats who last month urged Senate leaders to pay more attention to controlling federal health spending in this era of “exploding debt and deficits.”

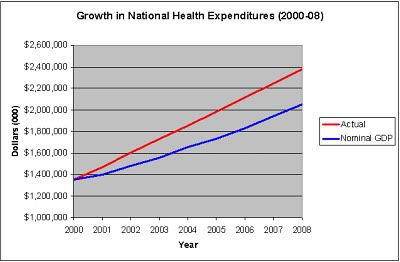

This latest assessment reflects the notion that credible health care reform legislation will need to address the chronic situation at which national health expenditures have been rising faster than nominal GDP.

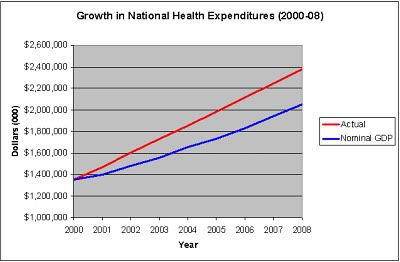

To take a closer look at the excess of growth in national health expenditures and nominal economic growth, from 2000 through 2008 national health expenditures increased from $1.353 trillion to $2.379 trillion. That is an average increase of 7.3% per year. During that same period, nominal GDP rose at an average rate of 5.3% per year. Had national health expenditures grown at the rate the economy grew, national health expenditures would have been $327 billion less than they were in 2008. Cumulative savings from 2000 through 2008 would have amounted to $1.735 trillion.

Looking ahead, the 2008 Annual Report of the Medicare Trustees projected that nominal GDP would expand at an annual rate of 4.9% from 2008 through 2018. In contrast, according to the Centers for Medicare and Medicaid Services forecast that national health expenditures would increase by an average of 6.2% per year. If those predictions play out, national health expenditures would be running $530 billion more in 2018 than if they increased at the rate the economy grew. Were national health expenditures to grow at the rate of nominal GDP during that timeframe, cumulative savings would amount to $1.719 trillion.

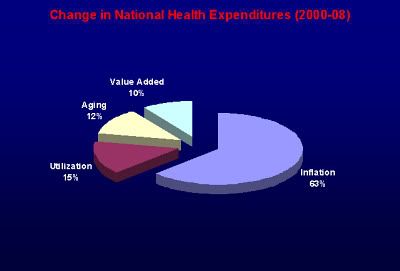

One of the major problems confronting policy makers is the absence of health care industry productivity data. Although the Bureau of Labor Statistics provides labor and output productivity for a large number of industries, that data does not include health services. In the absence of such data, it is difficult for policy makers to gain a good understanding of the root of the health expenditures imbalance.

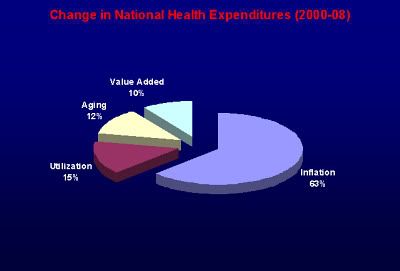

To gain a crude approximation, one must:

• Identify the share of increased expenditures that is due to medical price inflation.

• Identify the share of increased expenditures that is associated with the changing age structure of the U.S. population. In general, older persons have higher per capita health expenditures.

• Identify the share of increased expenditures that is associated with changes in utilization. Increased average consumption of health services boosts national health expenditures.

Once those tasks are completed, it can be assumed that the remaining increase in expenditures results from value added. That is a generous assumption, as myriad inefficiencies could explain at least part of the remaining increase in national health expenditures.

In any case, the 2000-2008 data reveals that the largest share of increased national health expenditures can be attributed to medical price inflation. The smallest share can be attributed to value added.

Overall, from 2000-2008, value added increased at an average of 1.2% per year. During that same period, the nonfarm business sector enjoyed average annual productivity growth of 2.5%. Productivity in the manufacturing sector increased 3.3% per year. As a result, the rough approximation of health industry value added hints that abnormally low productivity could be playing a role in helping drive medical price inflation.

If, in fact, that is the case, policy makers will need to consider provisions in the health reform legislation that would:

• Increase industry competition. Increasing industry competition would entail examining trade barriers that preclude greater competition from abroad, price protections that preserve arbitrage situations in pharmaceutical prices, and state-based regulatory barriers that limit competition.

• Improved education. Over time, improved medical education and training can lead to better outcomes.

• Encourage investment in technology and improved facility management practices. Technology and improved management can reduce inefficiencies over time.

• Address procurement practices. In general, when emerging technologies are purchased in their infancy, the cost-benefit ratio of such technologies is lower than when such technologies have evolved and advanced. Better procurement would take into consider cost curves associated with changing/emerging technologies.

&&

Democrats say it will be hard to push a reform bill through Congress unless it reduces projected spending on health care and begins to bring the federal debt under control…

“It's not good enough that it's just paid for; it actually has to start driving long-term costs down,” said Sen. Mark Warner (D-Va.), one of nine freshman Democrats who last month urged Senate leaders to pay more attention to controlling federal health spending in this era of “exploding debt and deficits.”

This latest assessment reflects the notion that credible health care reform legislation will need to address the chronic situation at which national health expenditures have been rising faster than nominal GDP.

To take a closer look at the excess of growth in national health expenditures and nominal economic growth, from 2000 through 2008 national health expenditures increased from $1.353 trillion to $2.379 trillion. That is an average increase of 7.3% per year. During that same period, nominal GDP rose at an average rate of 5.3% per year. Had national health expenditures grown at the rate the economy grew, national health expenditures would have been $327 billion less than they were in 2008. Cumulative savings from 2000 through 2008 would have amounted to $1.735 trillion.

Looking ahead, the 2008 Annual Report of the Medicare Trustees projected that nominal GDP would expand at an annual rate of 4.9% from 2008 through 2018. In contrast, according to the Centers for Medicare and Medicaid Services forecast that national health expenditures would increase by an average of 6.2% per year. If those predictions play out, national health expenditures would be running $530 billion more in 2018 than if they increased at the rate the economy grew. Were national health expenditures to grow at the rate of nominal GDP during that timeframe, cumulative savings would amount to $1.719 trillion.

One of the major problems confronting policy makers is the absence of health care industry productivity data. Although the Bureau of Labor Statistics provides labor and output productivity for a large number of industries, that data does not include health services. In the absence of such data, it is difficult for policy makers to gain a good understanding of the root of the health expenditures imbalance.

To gain a crude approximation, one must:

• Identify the share of increased expenditures that is due to medical price inflation.

• Identify the share of increased expenditures that is associated with the changing age structure of the U.S. population. In general, older persons have higher per capita health expenditures.

• Identify the share of increased expenditures that is associated with changes in utilization. Increased average consumption of health services boosts national health expenditures.

Once those tasks are completed, it can be assumed that the remaining increase in expenditures results from value added. That is a generous assumption, as myriad inefficiencies could explain at least part of the remaining increase in national health expenditures.

In any case, the 2000-2008 data reveals that the largest share of increased national health expenditures can be attributed to medical price inflation. The smallest share can be attributed to value added.