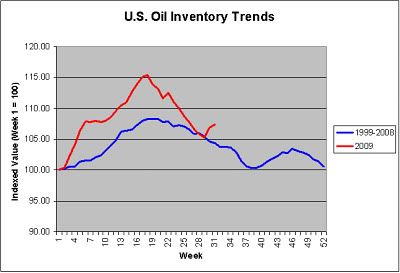

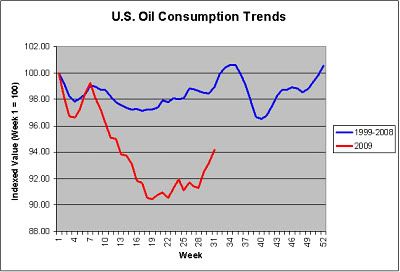

Reduced oil consumption due to the ongoing recession that has seen real GDP contract 3.9% from its peak through the Second Quarter has led to higher inventories. During the first 31 weeks this year, U.S. oil consumption has averaged 18.9 million barrels per day. That is 5.6% below the figure for the same period last year. In response, U.S. crude oil stocks have averaged 353.7 million barrels for the first 31 weeks this year. That is 15.1% above the average figure for the comparable period last year.

Nonetheless, U.S. oil consumption has continued to follow broad seasonal patterns albeit with a noticeably sharper falloff between winter heating season and the summer driving season.

If one transposes this year’s trends relative to the 10-year base, the recent uptick in oil inventories was not too surprising. However, assuming that this year’s dynamics remain relatively constant, oil inventories are not likely to rise significantly in coming weeks. Instead, the more normal pattern of falling inventories until sometime in mid- to late-September should resume.

The dynamics that have prevailed so far this year would suggest an initial peak near 350 million barrels before a fresh decline in inventories commences. Then, inventories could fall to around 338 million barrels. Afterward, in the run-up to heating season could again lift inventories to near 350 million barrels. If one considers a 1-2-standard deviation move from the patterns that have prevailed this year, one could see oil inventories bottom out in the 324 million to 331 million barrel range. That would be well above last year’s bottom of 290.2 million barrels. On the high-end, a 1-2-standard deviation difference from the patterns that have prevailed this year would suggest a latter-year peak of 357 million to 364 million barrel range. That would be well above last year’s 321.3 million barrel autumnal peak. However, it would be comfortably below the 375.3 million barrel figure reached for the four-week period ended May 1, 2009.

In the end, what is important is not the exact numbers discussed above, as they are merely meant to provide a quick sketch. What is important is that U.S. crude oil inventories are not likely to return to the peaks reached earlier this year unless the ongoing recession suddenly deepens anew. As a result, the kind of buildup in crude oil stocks that would help spark a fresh collapse in oil prices to or below the $33.87 figure reached on December 19, 2008, much less the $20 figure one analyst has forecast, is unlikely.

&&

No comments:

Post a Comment